lsvtc.ru

Learn

Whole Life Insurance Good Investment

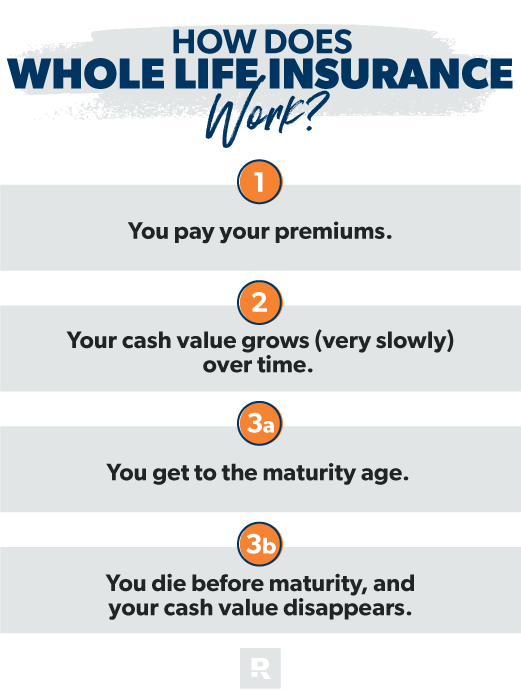

Reason #4: Whole Life Insurance Is a Good Investment for Some People Sure. Maybe. But not for your typical millennial. Whole life insurance policies can be a. Whole life is not the best investment vehicle. Universal is perhaps a better option, but a little riskier. As an agent that has sold term, whole. Generally, whole life is not a good investment. Term is usually better (if you are in need of pure death benefit). However, many agents try to. With whole life insurance, your policy's cash value increases annually, as long as you keep paying the premiums. Your premiums will stay the same, with a. Life insurance with cash value can be used as an investment tool. As you pay premiums, a portion goes toward your cash value, which will grow over time. Life insurance can be a valuable investment, as a policy can help financially support your loved ones after your death. It can also help cover large debts. Your death benefit is guaranteed. With some other forms of permanent life insurance, the death benefit may vary based on how well the policy's market. Whole Life Insurance: · You receive coverage your entire lifetime. · Premiums are typically higher, maximizing your payout long-term. · The death benefit is. Investing in a permanent life insurance policy can allow you to access the cash value in several ways based on your preferences and financial needs. If a life. Reason #4: Whole Life Insurance Is a Good Investment for Some People Sure. Maybe. But not for your typical millennial. Whole life insurance policies can be a. Whole life is not the best investment vehicle. Universal is perhaps a better option, but a little riskier. As an agent that has sold term, whole. Generally, whole life is not a good investment. Term is usually better (if you are in need of pure death benefit). However, many agents try to. With whole life insurance, your policy's cash value increases annually, as long as you keep paying the premiums. Your premiums will stay the same, with a. Life insurance with cash value can be used as an investment tool. As you pay premiums, a portion goes toward your cash value, which will grow over time. Life insurance can be a valuable investment, as a policy can help financially support your loved ones after your death. It can also help cover large debts. Your death benefit is guaranteed. With some other forms of permanent life insurance, the death benefit may vary based on how well the policy's market. Whole Life Insurance: · You receive coverage your entire lifetime. · Premiums are typically higher, maximizing your payout long-term. · The death benefit is. Investing in a permanent life insurance policy can allow you to access the cash value in several ways based on your preferences and financial needs. If a life.

New York Life has an A++ (Superior) AM Best rating, which is the highest financial strength rating the agency confers.1 It is also the oldest insurer on. Those interested in higher returns would do better to look for other investment opportunities such as an IRA or (k). Whole life policies are designed to. Whole life policies are guaranteed to build cash value over time, and this cash value can help you pay for big-ticket items like a new home or launching a. Some life insurance policies can become a financial asset for you to use during your life, just like an IRA or mutual fund. Permanent life insurance policies enable you to invest in conservative investments like mutual funds or exchange-traded funds (ETFs). You can choose how you. Whole life and other types of permanent coverage (such as universal life) provide a number of financial advantages compared to term life, but those benefits –. Buying Life Insurance · Variations of Term Life Policies · Cash Value · Dividends · You can use dividends in several ways: · Whole Life Policies with Investment. A whole life policy is great if you want lifelong coverage with a premium that won't change. Even if your health changes, your payments stay the same. Why buy. Benefits of Whole Life Insurance · Fixed Premiums · Accumulates Cash Value · Long-Term Protection · Keep Your Policy Through Injury or Illness · More Coverage When. Indeterminate Premium Whole Life: An indeterminate premium whole life policy is like a non-participating whole life plan of insurance except that it provides. For example, let's say you buy a whole life insurance policy at age When you purchase the policy, the premiums will be locked in for the life of the policy. Whole life insurance is typically more expensive than term life policies, but the premium amount is fixed for the life of the policy. Consistent cash value. The premium depends on your age at the time you buy and stays the same as you grow older. The lowest premiums go to those who buy it when they're young, because. From great coverage to fixed premiums, this type of policy offers many benefits. But before you move forward with a policy, it's a good idea to weigh the pros. Whole life insurance may be appealing to you if you are looking for long-term coverage that also allows you to borrow against the policy's cash value. Whole life insurance helps your family prepare for the unexpected. The guaranteed death benefit can help replace a family's loss of income, help with. Whole life insurance helps your family prepare for the unexpected. The guaranteed death benefit can help replace a family's loss of income, help with. Unlike a term life insurance policy that expires after a set amount of time, a whole life insurance policy never expires as long as you stay current on the. Buying Life Insurance · Variations of Term Life Policies · Cash Value · Dividends · You can use dividends in several ways: · Whole Life Policies with Investment. A properly designed whole life policy, used in conjunction with some specific wealth building principles, will increase your net worth substantially over the.

How Much Does Identity Guard Cost

How much does Identity Guard cost? Keep in mind in so far, the median loss from fraud is $ Even if you choose the most expensive package at $ ² day money back guarantee is only available for our annual plans purchased through our websites or via our Customer Support team. You may cancel your. 1. Aura For a limited time, you can save 60% on Aura — meaning an individual membership is just $6/month. Aura has been rated as the #1 identity theft. Starting at $ per month, get award-winning identity theft protection from a provider with 19 years experience. FreeKick Pricing ; Annual savings, $, $ ; Savings over 18 years, $10,, $8, If you decide not to cancel, your membership will continue and you will be billed $ plus applicable sales tax each month for Experian IdentityWorks SM. What is Identity Theft Protection? How does Identity Guard protect my identity? You can purchase annual coverage of Identity Guard's highest tier, its Ultra plan, for $ per month. IdentityForce's UltraSecure+Credit costs $ per. Worth noting, though, while their premium service tier costs the same — $ per month — this is a fixed rate that will not increase after a year. Advantage. How much does Identity Guard cost? Keep in mind in so far, the median loss from fraud is $ Even if you choose the most expensive package at $ ² day money back guarantee is only available for our annual plans purchased through our websites or via our Customer Support team. You may cancel your. 1. Aura For a limited time, you can save 60% on Aura — meaning an individual membership is just $6/month. Aura has been rated as the #1 identity theft. Starting at $ per month, get award-winning identity theft protection from a provider with 19 years experience. FreeKick Pricing ; Annual savings, $, $ ; Savings over 18 years, $10,, $8, If you decide not to cancel, your membership will continue and you will be billed $ plus applicable sales tax each month for Experian IdentityWorks SM. What is Identity Theft Protection? How does Identity Guard protect my identity? You can purchase annual coverage of Identity Guard's highest tier, its Ultra plan, for $ per month. IdentityForce's UltraSecure+Credit costs $ per. Worth noting, though, while their premium service tier costs the same — $ per month — this is a fixed rate that will not increase after a year. Advantage.

Identity Protection. $per month · Monitoring your information for signs of Identity Theft ; Total Protection. $per month · Credit AND Identity Protection. Best Overall: Identity Guard · Pricing: $ to $25 per month · Types of Protection Offered: Personal, financial, online, and child · 24/7 Customer Service: No. Identity theft insurance typically costs between $25 and $60 a year. Depending on how you purchase the insurance — either as a standalone policy, as a rider or. What should I do if I am a victim of identity theft? To start, protect Introductory pricing for new customers. *First year price. See offer details. Family Plans start at $ per month. Please note that the pricing information provided is current as of August Discounts apply for annual memberships. Compare the Identity Theft Protection from Discover with the competition and help protect yourself from identity theft cyber-crimes starting at $15 per. Since , IDX has been helping victims of data breaches with best-in-class identity and privacy protection – at no cost to them. Try Identity Guard risk-free today with plans starting at $/month (and a day money-back guarantee). Identity Guard Pros & Cons: Who Is Identity Guard For. How much does Identity Guard cost? ; Family – Annual, $ per month, $ per month, $ per month ; Family – Monthly, $ per month, $ per month. The cost of identity theft protection can vary depending on which company and plan you choose. In general, though, you can expect to pay anywhere from about $ Worth noting, though, while their premium service tier costs the same — $ per month — this is a fixed rate that will not increase after a year. Advantage. The pricing for family plans is straightforward: just double the cost of the individual plans. For top protection for an entire family, you can expect to pay. Cheap Pet Insurance How Much Does Pet Insurance Cost? Pet Insurance Pre ID theft insurance plans, the fine print often excludes ransom fees. Identity Guard: Starts at $/month; LifeLock: Starts at $/month; IDShield: Starts at $/month; IdentityForce: Starts at $/month; ID Watchdog. Identity Guard offers a range of plans offering basic identity and credit monitoring to advanced security for you and your family. For home title monitoring and. This is particularly true for families. LifeLock by Norton's family plan costs $80 per month. By comparison, IdentityForce's family plans won't run you more. After the day trial period is over, Blue plan subscriptions automatically renew at $19/mo for individuals and $36/mo for families unless canceled. Credit. Identity theft insurance typically costs between $25 and $60 a year. Depending on how you purchase the insurance — either as a standalone policy, as a rider or. How much does identity theft protection cost? Identity theft protection plans begin as low as $ per month. You could also save money by paying for annual. $ / mo. · $ / yr. · Elite Features · More About Identity Theft Protection · Did you know we also offer. Identity Theft Protection for your business?

How To Get Lowest Interest Rate Loan

A loan company may have interest rate ranges, but the lowest, most competitive rates may only be available to people who have excellent credit, as well as. Here are some of the program's features: • Competitive fixed interest rate loans • The property cannot exceed five acres and must have a minimum of square. 7 ways to get a lower mortgage rate · 1. Shop for mortgage rates · 2. Improve your credit score · 3. Choose your loan term carefully · 4. Make a larger down payment. To get a low-interest loan, you typically need a good credit score. A good credit rating suggests to lenders that you're a responsible borrower. Knowing your credit score (e.g., do you have fair, good, or excellent credit?) could explain why you might qualify for a higher or lower rate on a personal loan. 5 Best Ways to Get a Low Interest Personal Loan · Build and maintain your credit score of or above · Check for pre-approved instant personal loan offers from. Here's a look at things you can do to score a lower interest rate on a personal loan and save money while you pay it off. The more money you put down, the more stake you have in the property. Loan term: Shorter terms (like a year or a year) generally have smaller interest. Best low-interest personal loans · SoFi: Best for discounts. · Upgrade: Best for building credit. · Upstart: Best for thin credit. · PenFed: Best for small loans. A loan company may have interest rate ranges, but the lowest, most competitive rates may only be available to people who have excellent credit, as well as. Here are some of the program's features: • Competitive fixed interest rate loans • The property cannot exceed five acres and must have a minimum of square. 7 ways to get a lower mortgage rate · 1. Shop for mortgage rates · 2. Improve your credit score · 3. Choose your loan term carefully · 4. Make a larger down payment. To get a low-interest loan, you typically need a good credit score. A good credit rating suggests to lenders that you're a responsible borrower. Knowing your credit score (e.g., do you have fair, good, or excellent credit?) could explain why you might qualify for a higher or lower rate on a personal loan. 5 Best Ways to Get a Low Interest Personal Loan · Build and maintain your credit score of or above · Check for pre-approved instant personal loan offers from. Here's a look at things you can do to score a lower interest rate on a personal loan and save money while you pay it off. The more money you put down, the more stake you have in the property. Loan term: Shorter terms (like a year or a year) generally have smaller interest. Best low-interest personal loans · SoFi: Best for discounts. · Upgrade: Best for building credit. · Upstart: Best for thin credit. · PenFed: Best for small loans.

To get the lowest possible interest rate for a Personal Loan, you'll need a good credit score. To have a good credit score, you'll need to maintain an. If you need to borrow a relatively small amount, you could consider a 0% purchase credit card, and pay the debt off before the interest-free period ends. Other. The best way to get the lowest interest rate is to shop around and compare different lenders. Taking the time to research different lenders and. What do I need to get a personal loan?Expand The payment reduction may come from a lower interest rate, a longer loan term, or a combination of both. 7 ways to get a lower mortgage rate · 1. Shop for mortgage rates · 2. Improve your credit score · 3. Choose your loan term carefully · 4. Make a larger down payment. loans typically have lower interest rates than most credit cards. Since interest rates and loan terms on a personal loan are fixed, you can select a loan. Get the extra financial help you need. Use your Rate personal loan to help: Consolidate high-interest rate debt; Remodel your home; Cover unexpected expenses. Check loan statement to see what you're actually paying in interest each month at this point and see you really should refinance. Shop rates if. Before you apply, it's a good idea to compare personal loan rates and terms to make sure you are picking the right one to fit your needs and situation. It's. A helpful first step is to use a mortgage calculator, which estimates your monthly house payment, including principal, interest, taxes, and insurance. Before applying for a loan, think about why you want to take one out. Although some personal loans can have relatively low rates, they are still a form of debt. According to The Mortgage Reports' lender network, the lowest mortgage rates as of September are % (% APR) for a year fixed-rate conventional. Compare personal loan rates from top lenders for September ; LightStream · · Loan term. 2 - 7 years ; Prosper · · Loan term. 2 - 5 years. Get quotes from three or more lenders so you can see how they compare. Rates often change from when you first talk to a lender and when you submit your mortgage. If you need a mortgage to buy your home, you'll want to learn these ten tips to get the best mortgage rate and keep your costs low. Offers a one-day mortgage that lets eligible borrowers apply, lock in a rate and get a loan commitment within 24 hours. Average interest rates are on the low. Unsecured personal loan · $3, minimum loan amount · Rates range from % to % APR Excellent credit required for lowest rate · No origination fees. Loan need-to-knows · 1. Only borrow as much as you NEED to, then pay it back as quickly as you can · 2. yet it can cost less to borrow more – but be. Try to find banks that are in distress or not very well known credit unions. Remember banks take there sweet time with loans whereas brokers are. ICICI Bank offers one of the lowest interest rate Personal Loans with a competitive interest rate at %* p.a. How to get the lowest Interest Rate on a.

How Much Does Mastercard Charge Per Transaction

Typical costs per credit card transaction · Interchange fees: 1% to 4% per transaction · Processor (or merchant acquirer) fees: % to % per transaction . But your merchant may charge more or less, depending on the specific terms of its credit card merchant contract. Although surcharging is now permitted by credit. How much do credit card processing fees cost? The average credit card processing fee per transaction is % to %. The fees a company charges will depend on. How Interchange Fees Work Typically, interchange rates take the form of a percentage applied to sales volume plus a dollar-amount per transaction—for example. Q: What is the average credit card processing fee? On average, credit card processing fees range from % to % for card-present swiped transactions and. What is the average fee for credit card processing? Typical credit card processing fees range from %% of the total transaction. The exact amount will. On average, credit card processing fees can range between % and %. Fees can be charged per transaction, per month or per year depending on the credit card. Typically, this fee is around 3% per transaction. How to avoid foreign how much you're able to charge to your card. 8. Returned payment fee. If you. Visa – % – %. Average Credit Card Processing Fees_Credit Card Company Fees_Infographic. 3 Parties That Determine Average Merchant Processing Fees. There's. Typical costs per credit card transaction · Interchange fees: 1% to 4% per transaction · Processor (or merchant acquirer) fees: % to % per transaction . But your merchant may charge more or less, depending on the specific terms of its credit card merchant contract. Although surcharging is now permitted by credit. How much do credit card processing fees cost? The average credit card processing fee per transaction is % to %. The fees a company charges will depend on. How Interchange Fees Work Typically, interchange rates take the form of a percentage applied to sales volume plus a dollar-amount per transaction—for example. Q: What is the average credit card processing fee? On average, credit card processing fees range from % to % for card-present swiped transactions and. What is the average fee for credit card processing? Typical credit card processing fees range from %% of the total transaction. The exact amount will. On average, credit card processing fees can range between % and %. Fees can be charged per transaction, per month or per year depending on the credit card. Typically, this fee is around 3% per transaction. How to avoid foreign how much you're able to charge to your card. 8. Returned payment fee. If you. Visa – % – %. Average Credit Card Processing Fees_Credit Card Company Fees_Infographic. 3 Parties That Determine Average Merchant Processing Fees. There's.

Issuing bank fee: Depending on the credit card you use — such as Citibank, Chase or Barclays — some issuers add a charge on top of the network fee, usually. Amex: %; Discover: %; MasterCard: %; Visa: %. It is important to note that for flat rate pricing structures, most. With flat-rate pricing, the merchant pays a flat fee with a fixed percent per transaction added on top (e.g., % + $ per transaction). Interchange-plus. As a result, most credit card companies prohibit merchants from surcharging debit card transactions. Are businesses required to disclose a credit card surcharge. Merchants are permitted to apply either a brand-level surcharge or a product-level surcharge to Mastercard credit cards. The multiple parties who touch a transaction are responsible for interchange fees. Interchange fees are one portion of processing fees. Interchange fees are. Mastercard interchange rates are established by Mastercard and are generally paid by acquirers to card issuers on purchase transactions conducted on Mastercard. What is the average fee for credit card processing? Typical credit card processing fees range from %% of the total transaction. The exact amount will. For instance, if we use the % plus 30 cents per swipe applied to $, in annual credit card volume with an average transaction of $5, the flat rate fee. A brand level surcharge is one where the merchant charges the same percentage on all Mastercard credit cards. transaction receipt provided by the merchant to. For credit cards, the fees average just over 2% of the transaction but can be as much as 4% for some premium rewards cards. Fees for debit cards from the. Merchant service charge (MSC) · Debit cards: % to % · Credit cards: % to % · Commercial credit cards: % to %. Per-transaction charges sound deceptively tiny, ranging between 10 and 20 cents each. It's a few cents, right? How bad can that be? Well, these types of fees. Step 1: Per-transaction rate · Step 2: Add monthly service fee · Step 3: Add any applicable point-of-sale (POS) device costs. A credit card surcharge (or cc surcharge) is a fee enforced by the merchant to compensate for some of the cost of payment processing. This fee can only apply to. How does a merchant calculate the cap for the brand level surcharge that it can apply to. Mastercard credit cards? A. The cap is calculated based upon the. “When a merchant intends to surcharge, they are offsetting the costs that they would be paying by applying a surcharge to the transaction. The name. They include a flat charge (e.g. $) plus a percentage of the transaction amount (e.g. 2% to 3%). Interchange fees make up the largest portion of all credit. Merchant credit surcharging · Before you start · Surcharge considerations · How to disclose surcharging. merchant a way in which we can charge the clients the transaction fees? 3. Avatar. Donna J. 2 years ago. Christina: there are no plans to do this, as far as I.

Buy Lease Early

lease, we offer several options to end your lease early All parties listed on the lease agreement sign the purchase packet. You schedule a vehicle. You can “buy out” your lease early, or at the end of the term. Keep these points in mind as you consider an early lease buyout or a lease-end buyout: If you. Can you trade up or purchase your vehicle before the lease term is up? You can! Learn more about how you can turn in a lease early with this guide from. An early lease buyout occurs before the end of your lease. This may make sense if you know you want to purchase your leased vehicle but you still have months. Some leasing companies may allow you to end your lease early without having to pay a termination fee, but you'll still be responsible for the remaining. Lease swapping (finding someone else to take over your lease contract) is often the simplest option in these cases, but another route is to buy the car and then. Whether you're days, weeks, or even months away from the expiration date of your lease, a lease buyout makes it possible to end your lease ahead of schedule. Purchase the vehicle – By choosing the buyout of payoff option outlined in your lease contract, you can buy the vehicle and end your lease. Most of the time. If you only have a few months left on your lease, you may decide that it is better to wait until the term ends before returning your car. Early termination of a. lease, we offer several options to end your lease early All parties listed on the lease agreement sign the purchase packet. You schedule a vehicle. You can “buy out” your lease early, or at the end of the term. Keep these points in mind as you consider an early lease buyout or a lease-end buyout: If you. Can you trade up or purchase your vehicle before the lease term is up? You can! Learn more about how you can turn in a lease early with this guide from. An early lease buyout occurs before the end of your lease. This may make sense if you know you want to purchase your leased vehicle but you still have months. Some leasing companies may allow you to end your lease early without having to pay a termination fee, but you'll still be responsible for the remaining. Lease swapping (finding someone else to take over your lease contract) is often the simplest option in these cases, but another route is to buy the car and then. Whether you're days, weeks, or even months away from the expiration date of your lease, a lease buyout makes it possible to end your lease ahead of schedule. Purchase the vehicle – By choosing the buyout of payoff option outlined in your lease contract, you can buy the vehicle and end your lease. Most of the time. If you only have a few months left on your lease, you may decide that it is better to wait until the term ends before returning your car. Early termination of a.

Buying out eliminates the rent charge for future payments. I have the payoff numbers already.

If the dealer thinks you are planning on selling it back to them, they may offer you a better deal to keep the vehicle. Early Lease Buyout: You won't really. Were you to buy your leased vehicle at the end of term, the early termination fee is null, however most leases exact a purchase option fee when. Returning the car at lease-end is the typical choice for most lessees. · End-of-lease options include buying the car for the predetermined residual value. · The. Early Lease Buyout In some circumstances, you can also purchase your leased Mazda before the end of your contract. You'll need to look over your contract to. Most car leases allow you to break the lease early, but for a substantial fee. The amount you'll need to pay will depend on your lease and how much of the term. Early lease buyout involves purchasing the car for the amount still remaining on the lease. It's a good choice if you have concerns about exceeding lease. The second option is an early lease buyout, which is when you buy the vehicle before the lease contract actually ends. Be sure to check before you sign your. An early lease buyout occurs when you upgrade your vehicle before your contract expires. This is a more complicated option, but it can be convenient if you are. A lease buyout, sometimes referred to as a purchase option, allows you to purchase the car at the end of the lease instead of turning it in. Buying out your lease early can help you to avoid excess costs due to depreciation or lease penalties. Early lease buyout may be for you if: You want to avoid. If you want out of your current lease early because you'd like to buy a new car instead of leasing again, some dealerships (including Driveway) will work with. Generally, the price of buying out a car lease is non-negotiable. The lease-end buyout price will be determined at the time that you sign your contract, and the. Just because penalties might be charged doesn't mean you should give up on turning in your leased car early, especially if you plan to purchase a new vehicle. The most common reason that drivers choose the early lease buyout is to avoid penalties. For example, if you're close to exceeding your mileage or your car has. Were you to buy your leased vehicle at the end of term, the early termination fee is null, however most leases exact a purchase option fee when. In other words: if the market value of your vehicle is higher than the buyout price, you can avoid larger penalties by buying the car from the leasing company. Early Lease Buyout When you do an early lease buyout, you purchase your vehicle before lease-end. Not all lease agreements allow this, so check to see if it's. Review your lease agreement. Look for the residual value of the car and check the provisions for buying out your vehicle at the end of the lease, as well as any. The short answer is that yes, you can buy your leased car early in most cases. car leasing auto leasing lease buyout residual value buyout amount financing. With online information and resources, you can find the right way to end your lease early by selling, swapping, or buying your car.

Hair Toppers For Thinning Hair Amazon

The best hair topper ever! Reviewed in the United States on June 6, Color: Natural Black. I've bought 7 hair topper from Amazon and this is the best one. MY-LADY Hair Topper for Women Human Hair for Thinning Hair Loss 8 * 10CM Lace Silk Base Real Remy Hair No Bangs Clip in Hair Pieces Hand-Tied Hairpieces 10 Inch. % Real Human Hair with No bangs, Human Hair Toppers with 3 Clips, Swiss Lace Base Hand-Tied, Hair lossing/Thinning, Gray hair 14inch Ombre light brown. Toppers for Thinning Hair or Hair Loss Grey Hair, Short Blonde Toppers Hair Pieces for Women Large Base Hair Topper with Thick Hair: Beauty & Personal Care. Buy full-cap & lace front wigs for women in many styles & colors. Paula Young® offers high-quality synthetic & human hair wigs & wig care products. lsvtc.ru: Fine Plus Hair Toppers for Women Real Human Hair Topper with Bangs Hair Toppers Pieces for Women with Thinning Short Human Hair Toppers Clip in. % Real Human Hair Crown Topper Hair Pieces for Women with Thinning Hair, Susanki 6" x " Silk Top Hair Toppers with Clip on, 10" Off Black. lsvtc.ru: Hair Toppers for Women Real Human Hair 10 Inch Blonde Real Human Hair Toppers Hair Pieces for Women with Thinning Hair Toppers Hair Pieces for. LXUE Real Human Hair Toppers for Short Hair Hand Tied Clip in Topper Hairpiece for White Thinning Hair, 7 x 10cm Natural Black, 8" ; 5 x 8cm. $ · 25 · $ The best hair topper ever! Reviewed in the United States on June 6, Color: Natural Black. I've bought 7 hair topper from Amazon and this is the best one. MY-LADY Hair Topper for Women Human Hair for Thinning Hair Loss 8 * 10CM Lace Silk Base Real Remy Hair No Bangs Clip in Hair Pieces Hand-Tied Hairpieces 10 Inch. % Real Human Hair with No bangs, Human Hair Toppers with 3 Clips, Swiss Lace Base Hand-Tied, Hair lossing/Thinning, Gray hair 14inch Ombre light brown. Toppers for Thinning Hair or Hair Loss Grey Hair, Short Blonde Toppers Hair Pieces for Women Large Base Hair Topper with Thick Hair: Beauty & Personal Care. Buy full-cap & lace front wigs for women in many styles & colors. Paula Young® offers high-quality synthetic & human hair wigs & wig care products. lsvtc.ru: Fine Plus Hair Toppers for Women Real Human Hair Topper with Bangs Hair Toppers Pieces for Women with Thinning Short Human Hair Toppers Clip in. % Real Human Hair Crown Topper Hair Pieces for Women with Thinning Hair, Susanki 6" x " Silk Top Hair Toppers with Clip on, 10" Off Black. lsvtc.ru: Hair Toppers for Women Real Human Hair 10 Inch Blonde Real Human Hair Toppers Hair Pieces for Women with Thinning Hair Toppers Hair Pieces for. LXUE Real Human Hair Toppers for Short Hair Hand Tied Clip in Topper Hairpiece for White Thinning Hair, 7 x 10cm Natural Black, 8" ; 5 x 8cm. $ · 25 · $

lsvtc.ru: Aimeolyn Hair Toppers for Women Real Human Hair Toppers for Women No Bangs Top Hair Extensions Hair Pieces for Thinning Hair Wiglets Upgrade. You don't have to wash your hair topper like your natural hair. I recommend you to wash your hair topper once every two weeks because it. Official Bellami Hair Website. Get luscious full hair with hair extensions! Clip-In Hair Extensions, Synthetic Wigs, Human Hair Wigs, Styling Tools, Hair. % Human Hair Topper Toupee Light Thin Clip in Hair Bangs for Women and Men 6 inches Middle Part Straight Hairpieces for Mild Hair Loss Volume. 4 PCS Hair Toppers for Thinning Hair Synthetic Clip in Hair Extension Blonde & Bleach Blond Mixed Hairpieces for Women Adding Hair Volume for Daily Use. Human Hair Topper with Bangs Crown Topper Hair Pieces for Women Short Wiglet Topper for Thinning Hair * 13CM Silk Base % Real Human Hair Clip in Topper. Hair Pieces for Women with Thining Hair Human Hair Toppers Lace Base Clip in Topper Wiglets Hairpieces for Thinning Hair Adding Extra Hair Volume 10 Inch (1B#). lsvtc.ru: Human Hair Toppers for Women Hair Toppers for Thinning Hair Real Human Hair Toppers for Women Clip in 10Inch Hair Pieces for Women Hair. lsvtc.ru: VASILIA Real Human Hair Topper, Hair Toppers for Women with Thinning Hair Topper for Women Real Human Hair with No Bangs 10" Toppers Hair. 1 Hair Stop hair toppers for women are expertly crafted using % human hair, making them an ideal solution for who are seeking to conceal hair thinning. SEGO Human Hair Toppers for Women No Bangs,With Thinning Hair % Real Human Hair Top Wiglets Hairpieces % Density Silk Base Clip in Hair Topper for Hair. Replaceable Human Hair Topper Clip In With Air Bangs is made by % Brazilian virgin human lsvtc.rur and lighter than full wigs and more breathable and. Jurazza Hair Topper for Women. Hair topper is a game changer for women with thinning hair, it will change your look in one second without treaming hair. Elailite Human Hair Topper With Fringe Clip in For Women Thinning Hair - % Real Hair Invisible Toupee Mono Base Crown Hair Extension Hairpiece (#18/ Ash. lsvtc.ru: Human Hair Toppers for Women with Thinning Hair, Clips in 2" x 3" Silk Base Crown Topper Hairpieces, " Natural Black: Beauty & Personal. LXUE Large Base Human Hair Toppers for Serious Thinning Hair, Free Part Wiglet Hairpieces for Women, 8" Natural Black · 8". $$ ($$ / Ounce). Our hair toppers are helpful solutions for Alopecia Hair Loss or General Hair Thinning & Hair Loss of any kind. Here at Nish Hair toppers are available in. lsvtc.ru: Top Hairpieces Human Hair Topper with Side Part, Womens Realistic 5"x3" Mono Lace Forehead Topper for Thinning Hair Clip in, 12" Dark Brown. lsvtc.ru: UDU Hair Toppers for Women Real Human Hair highlights Human Hair Toppers with Bangs Clip In Bangs Wiglets Hair Pieces for Women with Thinning. lsvtc.ru: Human Hair Toppers for Women with Thinning Hair, Clips in 2" x 3" Silk Base Crown Topper Hairpieces, " Natural Black: Beauty & Personal.

Ally Bank Rates On Savings Accounts

Ally Bank Savings Account interest rates fare well compared to other financial institutions. Its savings account earns an APY of % APY on all balances. An interest checking account that helps you meet your spending goals. Features. Keep more of your money with no minimum balances, no hidden fees. Best for: Saving at a competitive rate. Access your money at any time, including by debit card and checks. Annual Percentage Yield % on all balance tiers. Chase. Chase Savings · PNC Bank. Standard Savings · Bank of America. Advantage Savings · Ally Bank. Online Savings Account · Citibank. Citi Savings - Access Account. The APY of our Savings Account is more than 5x the national average of % APY, based on the national average of savings accounts rates published in the FDIC. Ally Bank Savings Account · Annual Percentage Yield (APY). % APY · Minimum balance. None · Monthly fee. None · Maximum transactions. Unlimited withdrawals or. Our Annual Percentage Yields (APYs) are accurate as of 9/4/ APYs are variable and may change after the account is open. No minimum balance is required. With a rate this good, why stash your cash anywhere else? Ally Bank Savings Account. Annual Percentage Yield. %. on all balance tiers. Learn More. A. Its savings account earns an APY of % APY on all balances which beats the national average for savings accounts (% APY as of August 19, , according. Ally Bank Savings Account interest rates fare well compared to other financial institutions. Its savings account earns an APY of % APY on all balances. An interest checking account that helps you meet your spending goals. Features. Keep more of your money with no minimum balances, no hidden fees. Best for: Saving at a competitive rate. Access your money at any time, including by debit card and checks. Annual Percentage Yield % on all balance tiers. Chase. Chase Savings · PNC Bank. Standard Savings · Bank of America. Advantage Savings · Ally Bank. Online Savings Account · Citibank. Citi Savings - Access Account. The APY of our Savings Account is more than 5x the national average of % APY, based on the national average of savings accounts rates published in the FDIC. Ally Bank Savings Account · Annual Percentage Yield (APY). % APY · Minimum balance. None · Monthly fee. None · Maximum transactions. Unlimited withdrawals or. Our Annual Percentage Yields (APYs) are accurate as of 9/4/ APYs are variable and may change after the account is open. No minimum balance is required. With a rate this good, why stash your cash anywhere else? Ally Bank Savings Account. Annual Percentage Yield. %. on all balance tiers. Learn More. A. Its savings account earns an APY of % APY on all balances which beats the national average for savings accounts (% APY as of August 19, , according.

High Yield CD ; Ally Bank, 4 years, % APY, $0 ; Ally Bank, 5 years, % APY, $0. Ally Bank CD Rates. Ally Bank Savings rates. Rate History for Ally Bank. Best CD Rates and Savings Rates. High Yield CD ; Ally Bank, 4 years, % APY, $0 ; Ally Bank, 5 years, % APY, $0. The best savings account rates from our partners for September 6, · American Express image. Savings Account. American Express. Member FDIC. APY. %. With a high-yield savings account like the Ally Bank Savings Account, which offers % APY, you'll be able to earn interest on your savings while knowing your. Compare our savings, CD, money market, checking and IRA rates and features all in one place. Straightforward with no hidden fees. Ally Bank Member FDIC. With Ally Bank's Money Market Account, you'll get competitive rates, no overdraft fees and no monthly maintenance fees. Ally Bank, Member FDIC. Compare Ally Bank IRAs. · View a side-by-side comparison of our Ally Bank IRA accounts. · IRA High Yield CD · IRA Raise Your Rate CD · IRA Savings · Features offered. Can be used for overdraft protection for a Berkshire Bank checking account. Capital One –. Savings Account –. Fee-Free: No monthly fees to keep your account. Ally Bank High Yield CD Overview ; 3 months, %, No minimum ; 6 months, %, No minimum ; 9 months, %, No minimum ; 12 months, %, No minimum. Looking at my account today it looks like they decreased the savings rate again. It has stealthily gone down from % to % to % in the past month. The APY of our Savings Account is more than 5x the national average of % APY, based on the national average of savings accounts rates published in the FDIC. The current APY is %. Users of the Ally Online Savings Account can start earning interest right away, with no minimum balances required in their account. Additional Info. Annual Percentage Yield % on all balance tiers! Deposit checks remotely with Ally eCheck Deposit. Make unlimited ATM withdrawals at one of. Newtek Bank is a division of the company NewtekOne. It focuses on business banking products, including helpful dashboards, business checking, and business MMAs. Reviews and rates for Ally Bank, a Utah-based Internet bank well known for its hassle-free savings accounts, checking accounts, money market and. Ally Bank should rank highly on your list of options to consider. Because it is an online bank, it can offer better rates, as it does not have to worry about. Very high annual percentage yield (APY). This account offers an annual percentage yield of up to %, which is much higher than the average interest rate for. Ally Bank Savings Account · No minimum balance. · No maintenance fees. · Competitive interest rate. · Interest compounded daily. · No overdraft fees. · Direct deposit. Ally Bank High Yield certificates of deposit: These CDs have terms ranging from three months to five years, with APYs of % to %, depending on the term.

Best Body Skincare

From moisturising to exfoliating, it's important to look after your body. Here are the best lotions, creams, oils, scrubs and body brushes to add to your. Body Care Products. SkinCeuticals body care products include targeted skincare What body lotion is good for dry skin? Body lotions are designed to. iS CLINICAL. Youth Body Serum · Bella Medical. The Perfect Body Lotion · Bella Medical. The Perfect Body Wash · Omnilux. Omnilux Contour™ Neck & Décolleté. Explore body skincare products by Image Skincare. Our BODY SPA collection Best selling. Alphabetically, A-Z. Alphabetically, Z-A. Price, low to high. Uplift your self-care routine with the use of our carefully hand-crafted skincare and body care tools. Make your skin look better by using these tools to. With the right products, you can ensure that you look, feel, and smell great wherever you go. Our body cleanser collection features body scrubs for baths or. I love necessaire! Their body lotion is great as well as the body wash. The lotion is only sold fragrance free. The sandalwood scent is my. 10 products ; retinol body cream - cocokind. retinol body cream. youthful body skin treatment. (59) ; sake body lotion - cocokind. sake body lotion. lightweight. Discover the best body care routine and learn more about Kiehl's tips and recommended formulas for healthier, smoother, glowing body skin. From moisturising to exfoliating, it's important to look after your body. Here are the best lotions, creams, oils, scrubs and body brushes to add to your. Body Care Products. SkinCeuticals body care products include targeted skincare What body lotion is good for dry skin? Body lotions are designed to. iS CLINICAL. Youth Body Serum · Bella Medical. The Perfect Body Lotion · Bella Medical. The Perfect Body Wash · Omnilux. Omnilux Contour™ Neck & Décolleté. Explore body skincare products by Image Skincare. Our BODY SPA collection Best selling. Alphabetically, A-Z. Alphabetically, Z-A. Price, low to high. Uplift your self-care routine with the use of our carefully hand-crafted skincare and body care tools. Make your skin look better by using these tools to. With the right products, you can ensure that you look, feel, and smell great wherever you go. Our body cleanser collection features body scrubs for baths or. I love necessaire! Their body lotion is great as well as the body wash. The lotion is only sold fragrance free. The sandalwood scent is my. 10 products ; retinol body cream - cocokind. retinol body cream. youthful body skin treatment. (59) ; sake body lotion - cocokind. sake body lotion. lightweight. Discover the best body care routine and learn more about Kiehl's tips and recommended formulas for healthier, smoother, glowing body skin.

When you use Epicuren Discovery body polish, you're giving your skin the very best care you can. Made from essential oils, our body polish line gives you the. What should your body skin care routine include? · Body care begins in the shower · Exfoliate your skin · Skin-friendly shaving · Moisturise your skin. Body Care Sets · Peony Fig Body Ritual · Next Generation Body Scrub Fragrance Trio · Discovery Body Ritual Kit Patchouli Lavender Vanilla. Hi~ today I made a video comparing and reviewing my body products focused on hydration -so lotion, cream, mask, every hydration related. Discover the best body care routine and learn more about Kiehl's tips and recommended formulas for healthier, smoother, glowing body skin. Indulge your body with the best natural body lotions, toners, scrubs & more. We harness local Italian ingredients to improve your skin's health. Shop here! Explore our Best-Sellers ; Brighten + Boost, Botanical Skin Tonic. Gotu Kola + Bilberry Extracts · ; Barrier Defense, High-Performance Serum. Ceramides. How to Get Started with a Full-Body Skin Care Routine · Step 1: Cleanse · Step 2: Exfoliate · Step 3: Treat · Step 4: Moisturize · Step 5: Seal · Step 6: Protect. Skin Woes:Uneven Skin Texture / Sun Damage / Blotchiness. Product ExperienceThe best body moisturizer on the market. See more. 12/12/ Franchesca. Verified. LAVISH Ultra Rich Body Butter - EVER Allure Best of Beauty Award Quick view LAVISH Ultra Rich Body Butter $ USD. Best Sellers: Body · BEST_SELLER Moisture-Rich Body Lotion 3 Sizes Price is now $ Rated stars of 5 · BEST_SELLER Tonic Body-Firming + Tightening-. For example, Cetaphil Ultra Gentle Body Wash and Dove Sensitive Skin Body Wash are great choices for sensitive skin. 2. Moisturizers. Body. body care ; best seller. take care + nourishadvanced hydration body moisturizer ; best seller. take care + polishrevitalize & cleanse body exfoliator ; save 19%. Ua Body is the continuation of natural skincare our family formulated 30 years ago. We honor our legacy by providing products with clean, additive-free. Show your skin some love using BeautyBio's collection of body skincare products. We've got firming body creams, nourishing body oils, and body rollers. A body oil or lotion can deliver nutrient-rich, moisturizing ingredients to even out texture and prevent flaking skin and ashiness. My best-selling body and skincare essentials. Say goodbye to KP, chicken skin, breakouts, and acne with my effective body scrubs, lotions and treatments. body Body (3 products); brighteners Brighteners (1 product); correction best seller (2) best seller (2 products); Body Contouring (1) Body Contouring. Not to mention how great you will feel wearing this ultra-luxe formula. To get that full-body filter effect, apply generously. Firm + Flaunt Targeted Booty Balm. Body Skincare: Eczema, Keratosis Pilaris, Acne, & Anti-Aging! | Dr Best of The Ordinary | DOCTORLY Favorites. Doctorly•2M views ·

What Is An Etf Investopedia

An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. Actively-managed ETFs invest in a portfolio of securities that is subjectively chosen by a fund manager on their own rather than follow a rules-based index. An exchange-traded fund (ETF) is a basket of securities that tracks or seeks to outperform an underlying index. ETFs can contain investments such as stocks and. Exchange-Traded Funds are subject to risks similar to those of stocks. Investment returns may fluctuate and are subject to market volatility, so that an. Our complete list of active exchange traded funds (ETFs) includes up LQD iShares iBoxx $ Investment Grade Corporate Bond ETF. + (+ Index domestic equity mutual funds and index-based exchange-traded funds (ETFs), have benefited from a trend towards more index-oriented investment products. Key Takeaways · ETFs are considered to be low-risk investments because they are low-cost and hold a basket of stocks or other securities, increasing. Key takeaways · Exchanged-traded funds (ETFs) are pooled investment vehicles similar to mutual funds. · ETFs track a particular index and can be actively traded. Key Takeaways · An index fund is a portfolio of stocks or bonds designed to mimic the composition and performance of a financial market index. · Mutual and. An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. Actively-managed ETFs invest in a portfolio of securities that is subjectively chosen by a fund manager on their own rather than follow a rules-based index. An exchange-traded fund (ETF) is a basket of securities that tracks or seeks to outperform an underlying index. ETFs can contain investments such as stocks and. Exchange-Traded Funds are subject to risks similar to those of stocks. Investment returns may fluctuate and are subject to market volatility, so that an. Our complete list of active exchange traded funds (ETFs) includes up LQD iShares iBoxx $ Investment Grade Corporate Bond ETF. + (+ Index domestic equity mutual funds and index-based exchange-traded funds (ETFs), have benefited from a trend towards more index-oriented investment products. Key Takeaways · ETFs are considered to be low-risk investments because they are low-cost and hold a basket of stocks or other securities, increasing. Key takeaways · Exchanged-traded funds (ETFs) are pooled investment vehicles similar to mutual funds. · ETFs track a particular index and can be actively traded. Key Takeaways · An index fund is a portfolio of stocks or bonds designed to mimic the composition and performance of a financial market index. · Mutual and.

An ETF, or exchange traded fund, is a collection of stocks, bonds, or other commodities (such as precious metals or oil) that are bundled together and sold on. Below, we explore the origins of ETFs, highlight the factors that contributed to their widespread adoption, and examine how they have changed with the market. Many investors are familiar with mutual funds and exchange-traded funds (ETFs), which allow them to invest in a pre-selected “basket” of stocks, often to. PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund - USR The Fund seeks to provide total return that closely corresponds. Mutual Funds and ETFs are pooled investments that enable low-cost diversification, and are similar in many respects but have some notable differences. Synthetic replication allows ETF investors to invest in new markets and investment classes. The ETF does not invest in the underlying markets, but only maps. Exchange-traded funds (ETFs) were created to combine the best characteristics of stocks and mutual funds in an investment vehicle. Both ETFs and CEFs allow an investor to purchase shares of a professionally managed fund without needing a large initial investment. The iShares Core S&P Total U.S. Stock Market ETF seeks to track the investment results of a broad-based index composed of U.S. equities. ACCESS MEGA FORCES IN A MULTI-THEMATIC TICKER WITH iSHARES EXPONENTIAL TECHNOLOGIES ETF (XT). Through a single trade, XT provides exposure to nine pivotal. An ETF is formed in the following way: The authorized participant acquires stock shares and places those shares in a trust, then uses them to form ETF creation. Mutual funds and ETFs can hold portfolios of investments like stocks, bonds, or commodities. They both adhere to the same regulations, like what they can own. An exchange-traded fund (ETF) is a basket of securities that trades on an exchange just like a stock does. But that's not all. Losses in ETFs usually are treated just like losses on stock sales, which generate capital losses. The losses are either short term or long term, depending on. Exchange-traded funds are investment products consisting of a basket of securities that may bring diversification to an investment portfolio. Both exchange-traded funds (ETFs) and index mutual funds are popular forms of passive investing, a term for an investment strategy that aims to match—not beat—. Why use Defined Outcome ETF™ investing? The most common reason for using Defined Outcome ETF™ investing is for the ability to invest with a built-in buffer. The BlackRock Flexible Income ETF seeks to maximize long-term income by primarily investing in debt and income-producing securities with a secondary objective. Exchange-traded funds (ETFs) were created to combine the best characteristics of stocks and mutual funds in an investment vehicle. Exchange-traded notes (ETNs) may have a similar sounding name, but ETNs are not the same as ETFs, and they carry some important risks to be aware of.

What Is The Difference Between Quickbooks Online And Desktop

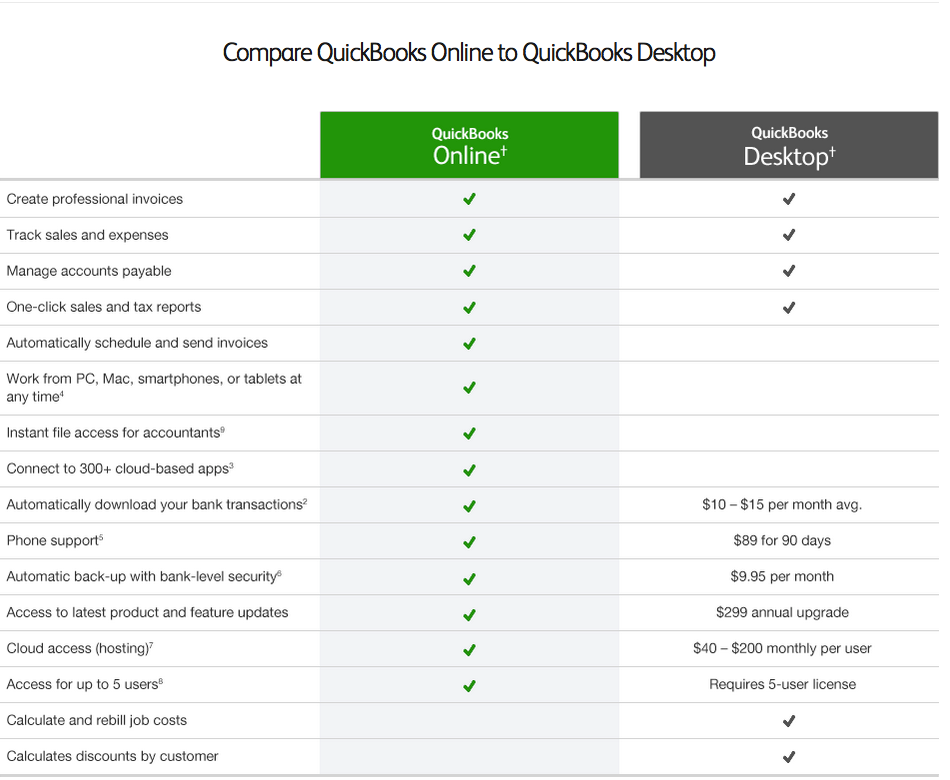

QuickBooks Desktop is hosted locally, while QuickBooks Online is hosted in the cloud. This means that QuickBooks Desktop users are limited to one hosting. QBO backs up automatically every few minutes while desktop forces you to come up with a contingency and recovery plan unless a QuickBooks Desktop hosting. The main difference between QuickBooks Desktop and Online is that QuickBooks Desktop is desktop-based, while QuickBooks Online, you guessed it, is a cloud. With the rise of QuickBooks's cloud-based solution, many agencies are confused about the difference between QuickBooks Desktop (QBD) and QuickBooks Online (QBO). QuickBooks Online vs. Desktop · Flexibility to work where you want** · Live collaboration · Multiple users included · Time-saving automation · Mobile app included**. For the layman, the major difference is that the former is cloud-based and can be accessed online, while the latter is installed on a computer to be locally. QuickBooks Functionality Comparison On functionality, Quickbooks Enterprise will win every time. QuickBooks Online has the edge in accessibility but. In contrast, QuickBooks Enterprise caters to larger businesses that need advanced features and customization. Ultimately, choosing the right QuickBooks version. Compare QuickBooks Desktop with QuickBooks Online to find the best solution for your business. Find the right QuickBooks product for your business. QuickBooks Desktop is hosted locally, while QuickBooks Online is hosted in the cloud. This means that QuickBooks Desktop users are limited to one hosting. QBO backs up automatically every few minutes while desktop forces you to come up with a contingency and recovery plan unless a QuickBooks Desktop hosting. The main difference between QuickBooks Desktop and Online is that QuickBooks Desktop is desktop-based, while QuickBooks Online, you guessed it, is a cloud. With the rise of QuickBooks's cloud-based solution, many agencies are confused about the difference between QuickBooks Desktop (QBD) and QuickBooks Online (QBO). QuickBooks Online vs. Desktop · Flexibility to work where you want** · Live collaboration · Multiple users included · Time-saving automation · Mobile app included**. For the layman, the major difference is that the former is cloud-based and can be accessed online, while the latter is installed on a computer to be locally. QuickBooks Functionality Comparison On functionality, Quickbooks Enterprise will win every time. QuickBooks Online has the edge in accessibility but. In contrast, QuickBooks Enterprise caters to larger businesses that need advanced features and customization. Ultimately, choosing the right QuickBooks version. Compare QuickBooks Desktop with QuickBooks Online to find the best solution for your business. Find the right QuickBooks product for your business.

QuickBooks Online is better suited for simpler accounting tasks, such as invoicing and tracking expenses. It is important to consider the accounting needs of. One of the significant differences is that QBO offers QuickBooks Live Bookkeeping. This bookkeeping service lets small business owners pay for professional. 1. QuickBooks online is web-based and you pay monthly to use it. So, you log into your QuickBooks Online account over the Internet. With QuickBooks Desktop you. Understanding the Differences Between QuickBooks Online and QuickBooks Desktop. When choosing an accounting software for your business, QuickBooks offers two. We use QB desktop and have no intention to ever go online. The desktop version is subscription based, but is still cheaper than online. The big. What is the Difference between QuickBooks Online and QuickBooks Desktop? ; Maximum number of users, 25 for QuickBooks Online Advanced, 40 for Desktop Enterprise. For example, if your business takes raw materials or components and builds products to sell to the end user, the desktop version of QuickBooks is a great choice. The most obvious difference between QuickBooks Online and Desktop is the pricing scheme. As we've mentioned above, the Online version works on a monthly. There are many differences between QuickBooks Online Plus and QuickBooks Pro primarily because one is a desktop “windows based” software while QuickBooks. QuickBooks Desktop Pro is the traditional accounting software that requires users to download and install on their computer. QuickBooks Online is a cloud-based. QuickBooks Online · QuickBooks Solopreneur · QuickBooks Money · QuickBooks Payroll · QuickBooks Contractor Payments · QuickBooks Time · QuickBooks Desktop Enterprise. QuickBooks Desktop in the cloud provides the same environment like your local desktop. Therefore, it allows you to access all the features of accounting. Another key difference is that being a cloud-based software, QuickBooks Online automatically does data encrypted back-ups. The desktop version of the software. Another key difference between QuickBooks Online and Desktop is that the former allows you to track your activity, such as income and expenses, by class and. Key differences between QuickBooks Desktop vs Online ; Accessibility, Accessible anywhere with an internet connection, Only accessible from the machine where. Compared to QuickBooks Online's extensive integration options, QuickBooks Desktop offers a more limited selection of around integrations. While it does. One more significant distinction between QuickBooks Desktop and Online is that the former lets you monitor your activity, including earnings and outlays. The main distinction between these two Quickbooks items is that Quickbooks online is cloud-based and operates on the Internet, whereas Quickbooks desktop is. QuickBooks Online offers the advantage of being accessible from anywhere with an internet connection, while QuickBooks Desktop is limited to the device it's. The software runs a cloud-based solution which also comes with a mobile app. This feature implies that you can have remote access to the software anywhere and.