lsvtc.ru

Overview

Qatar Etf

iShares MSCI Qatar ETF. QAT tracks a market-cap-weighted index of large-, mid and small-cap Qatari companies. The fund invests in public equity markets of Qatar. It invests in stocks of companies operating across diversified sectors. ETFs with Qatar Exposure ; QAT · iShares MSCI Qatar ETF · Emerging Markets Equities, %, % ; FTAG · First Trust Indxx Global Agriculture ETF · Large Cap. Explore the latest news, in-depth analysis, performance evaluation, and Q&A for iShares MSCI Qatar ETF (QAT). Gain valuable insights from earnings call. Ishares Msci Qatar Etf share price live: QAT Live stock price with charts, valuation, financials, price target & latest insights. Complete iShares MSCI Qatar ETF funds overview by Barron's. View the QAT funds market news. Find the latest quotes for iShares MSCI Qatar ETF (QAT) as well as ETF details, charts and news at lsvtc.ru The first ETFs in Qatar will track well known equity indices calculated by QSE. Typically stocks in an equity index are weighted by market capitalization. The index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market in Qatar. The underlying index uses a. iShares MSCI Qatar ETF. QAT tracks a market-cap-weighted index of large-, mid and small-cap Qatari companies. The fund invests in public equity markets of Qatar. It invests in stocks of companies operating across diversified sectors. ETFs with Qatar Exposure ; QAT · iShares MSCI Qatar ETF · Emerging Markets Equities, %, % ; FTAG · First Trust Indxx Global Agriculture ETF · Large Cap. Explore the latest news, in-depth analysis, performance evaluation, and Q&A for iShares MSCI Qatar ETF (QAT). Gain valuable insights from earnings call. Ishares Msci Qatar Etf share price live: QAT Live stock price with charts, valuation, financials, price target & latest insights. Complete iShares MSCI Qatar ETF funds overview by Barron's. View the QAT funds market news. Find the latest quotes for iShares MSCI Qatar ETF (QAT) as well as ETF details, charts and news at lsvtc.ru The first ETFs in Qatar will track well known equity indices calculated by QSE. Typically stocks in an equity index are weighted by market capitalization. The index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market in Qatar. The underlying index uses a.

Latest iShares MSCI Qatar ETF (QAT:NMQ:USD) share price with interactive charts, historical prices, comparative analysis, forecasts, business profile and. iShares MSCI Qatar ETF (QAT) is a passively managed International Equity Miscellaneous Region exchange-traded fund (ETF). iShares launched the ETF in The. View the latest iShares MSCI Qatar ETF (QAT) stock price and news, and other vital information for better exchange traded fund investing. This page shows the top ETFs with exposure to Qatar. ETF Name, Fund Family, Allocation (%). QAT - iSHARES TRUST - iShares MSCI Qatar ETF · iShares Trust. Al Rayan Qatar ETF is one of the lowest cost single-country ETFs across emerging markets. Benefits of investing in QATR Global popularity of ETFs. ETF information about iShares MSCI Qatar ETF, symbol QAT, and other ETFs, from ETF Channel. Get iShares MSCI Qatar ETF (QAT) real-time share value, investment, rating and financial market information from Capital. Learn everything you need to know about iShares MSCI Qatar ETF (QAT) and how it ranks compared to other funds. Research performance, expense ratio. Performance charts for iShares MSCI Qatar ETF (QAT - Type ETF) including intraday, historical and comparison charts, technical analysis and trend lines. Zacks proprietary quantitative models divide each set of ETFs following a similar investment strategy (style box/industry/asset class) into three risk. The Fund seeks to track the investment results of the MSCI All Qatar Capped Index, which is designed to measure the equity market in Qatar. The Fund generally. QAT Analysis & Insights. QAT tracks a market-cap-weighted index of large-, mid and small-cap Qatari companies. QAT launched in late April , coinciding with. Learn more about Qatar ETFs including comprehensive lists, performance, dividends, holdings, expense ratios, technicals and daily news. QAT | A complete iShares MSCI Qatar ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. Get the latest iShares MSCI Qatar ETF (QAT) real-time quote, historical performance, charts, and other financial information to help you make more informed. This is a list of all Qatar ETFs traded in the USA which are currently tagged by ETF Database. Please note that the list may not contain newly issued ETFs. View Ishares Trust Msci Qatar Etf (QAT) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. The investment seeks to track the investment results of the MSCI All Qatar Capped Index. The fund generally will invest at least 80% of its assets in the. iShares MSCI Qatar ETF. Fact Sheet as of Jun The iShares MSCI Qatar ETF seeks to track the investment results of an index composed of Qatar equities. iShares Trust - iShares MSCI Qatar ETF is an exchange traded fund launched by BlackRock, Inc. It is managed by BlackRock Fund Advisors.

Credit Card Offers For 600 Credit Score

Yes, you can get a credit card with a credit score. While you may not qualify for the most lucrative cards with extensive rewards or low-. A credit score may mean you have limited options for some loans and lines of credit. Those that you do qualify for may charge a higher interest rate and. Discover it® Secured Card The Discover it® Secured Card is an all-around winner, offering purchase rewards, flexible credit requirements, and no annual fee. rewards. Financial institutions like credit unions tend to offer great rewards credit cards. How can I compare credit card offers before making a decision? IDFC FIRST WoW Credit Card · Rupicard · OneCard Credit Card · Best Credit Cards for Low Credit Score · Understanding Credit Scores · Credit Cards for Bad Credit. For example, you may have had to take on loads of credit card debt due to job loss. If this helped you survive a tough time then it is what it is. But at some. A FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline. 5 personal loans for a credit score · Avant: Best for all credit types · Best Egg: High approval rates if you prequalify · OneMain Financial: Best bad credit. Capital One Platinum Credit Card. The Capital One Platinum Credit Card is designed for consumers with fair or limited credit. It's an unsecured card, but it. Yes, you can get a credit card with a credit score. While you may not qualify for the most lucrative cards with extensive rewards or low-. A credit score may mean you have limited options for some loans and lines of credit. Those that you do qualify for may charge a higher interest rate and. Discover it® Secured Card The Discover it® Secured Card is an all-around winner, offering purchase rewards, flexible credit requirements, and no annual fee. rewards. Financial institutions like credit unions tend to offer great rewards credit cards. How can I compare credit card offers before making a decision? IDFC FIRST WoW Credit Card · Rupicard · OneCard Credit Card · Best Credit Cards for Low Credit Score · Understanding Credit Scores · Credit Cards for Bad Credit. For example, you may have had to take on loads of credit card debt due to job loss. If this helped you survive a tough time then it is what it is. But at some. A FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline. 5 personal loans for a credit score · Avant: Best for all credit types · Best Egg: High approval rates if you prequalify · OneMain Financial: Best bad credit. Capital One Platinum Credit Card. The Capital One Platinum Credit Card is designed for consumers with fair or limited credit. It's an unsecured card, but it.

Credit scores are used by potential lenders and creditors, such as: banks, credit card companies or car dealerships, as one factor when deciding whether to. The Petal® 2 "Cash Back, No Fees" Visa® Credit Card 1 is one of our top picks if you have a credit score because it has a $0 annual fee and offers cash. If you apply for Apple Card and your application is approved, there's no impact to your credit score until you accept your offer. A credit score may mean you have limited options for some loans and lines of credit. Those that you do qualify for may charge a higher interest rate and. If you're looking for the best credit cards for an under credit score, the Applied Bank Secured Visa Gold Preferred Credit Card is the perfect option. If you apply for Apple Card and your application is approved, there's no impact to your credit score until you accept your offer. A credit score of is considered to be on the lower end of the credit rating spectrum. It indicates that the person may have had some difficulties in. Capital One credit cards for fair credit include QuicksilverOne, Quicksilver Secured, and the Platinum Mastercard. Your credit score is only one of the many. Chase Freedom Unlimited®: Best feature: Flexible cash back rewards. IHG One Rewards Traveler Credit Card: Best feature: Bonus points at IHG hotels. Delta. Credit cards for fair credit target consumers with FICO scores between and These cards lack the splashy rewards of credit cards for good or excellent. Good builder/rebuilder cards are Discover and Capital One. Both creditors offer pre-approval tools that won't require a hard pull prior to. Credit cards for those with a credit score With this range, you can get some access to cards (including no-fee cards or student credit cards) but you will. A credit score of is high enough for you to be considered for a credit card. But don't have any illusions — a score is still subprime, and the unsecured. Best Overall Rewards Credit Card. Credit cards offer cardholders travel points, cash back or low interest rates for making day-to-day purchases. However, some. In Canada, most card providers view a credit score of as satisfactory but will take into consideration a variety of factors when assessing an application. Since is considered to be a fair credit score, borrowers with this score generally won't qualify for credit cards with large welcome bonuses, generous. 18 partner offers ; AvantCard · 2% (cash back) · %* Variable · $0* ; Capital One QuicksilverOne Cash Rewards Credit Card · %-5% (cash back) · % (Variable). offer(s) of credit. Submitting for a pre-approval is how you find out if you may be eligible for a Petal credit card without impacting your credit score. There are "base" FICO® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card. Credit scores are used by potential lenders and creditors, such as: banks, credit card companies or car dealerships, as one factor when deciding whether to.

How To Get Thin In One Week

Aim to exercise most days of the week. For even more health benefits, get minutes a week or more of moderate aerobic activity. Exercising this much may help. Set a realistic goal: · Create an exercise plan for 7 days: · Create a meal plan: · Create a list of eating habits: · Get rid of some eating habits: · Practice. 1. Add protein to your diet When it comes to weight loss, protein is the king of nutrients. A high-protein diet can also make you feel more full and reduce. A key to losing weight and keeping it off is adopting healthy eating as a lifestyle. We live in a great time for healthy eating, as there are more and more. Do · get active for minutes a week – you can break this up into shorter sessions · aim to get your 5 A Day – 80g of fresh, canned or frozen fruit or. find yourself back at square one. The first rule of integrating cheat days week. This planned splurge in calories often allows people to forgo. Losing weight in 7 days is not impossible. You can indeed see results in just one week as long as you workout everyday and combine it with a. The most important component of an effective weight-management program must be the prevention of unwanted weight gain from excess body fat. The military is in a. Just like keeping a diary of your eating habits, you could also keep a diary for a week to see how much physical activity you're doing. Include instances of. Aim to exercise most days of the week. For even more health benefits, get minutes a week or more of moderate aerobic activity. Exercising this much may help. Set a realistic goal: · Create an exercise plan for 7 days: · Create a meal plan: · Create a list of eating habits: · Get rid of some eating habits: · Practice. 1. Add protein to your diet When it comes to weight loss, protein is the king of nutrients. A high-protein diet can also make you feel more full and reduce. A key to losing weight and keeping it off is adopting healthy eating as a lifestyle. We live in a great time for healthy eating, as there are more and more. Do · get active for minutes a week – you can break this up into shorter sessions · aim to get your 5 A Day – 80g of fresh, canned or frozen fruit or. find yourself back at square one. The first rule of integrating cheat days week. This planned splurge in calories often allows people to forgo. Losing weight in 7 days is not impossible. You can indeed see results in just one week as long as you workout everyday and combine it with a. The most important component of an effective weight-management program must be the prevention of unwanted weight gain from excess body fat. The military is in a. Just like keeping a diary of your eating habits, you could also keep a diary for a week to see how much physical activity you're doing. Include instances of.

Aim for a rate of weight loss of up to 1kg per week “For most people, if they have an hour a day, and they are happy doing an hour a day of exercise, then. Still, further fat loss results usually come at a rate of about one pound per week if following a dedicated dietary and exercise regimen. If you only diet, you. 1. Add protein to your diet When it comes to weight loss, protein is the king of nutrients. A high-protein diet can also make you feel more full and reduce. Do you want to know how much weight you can lose in just one week get started!❤️ **If you want to be notified when I upload a new. Do · get active for minutes a week – you can break this up into shorter sessions · aim to get your 5 A Day – 80g of fresh, canned or frozen fruit or. Losing weight in 7 days is not impossible. You can indeed see results in just one week as long as you workout everyday and combine it with a. 1. Skipping meals Skipping meals is not an effective way to lose weight. When you skip a meal, you could become tired, miss out on essential nutrients. As time passes you will lose weight and you'll need to recalculate your calorie requirement. At your new weight you'll find your daily requirement has dropped. You can increase the number of days you walk each week to increase your calories burned. How to burn more calories while walking. 1. Monitor your heart rate. weight loss does not meet the now-outdated one-pound-per-week expectation. 2. Make diet and physical activity changes that you can stick with long-term. For. This makes it increasingly difficult to lose weight over a period of months. A lower rate of burning calories may also make it easier to regain weight after a. Drink some water, brush your teeth, and move on. Everyone who's ever tried to lose weight has found it challenging. When you slip up, the best idea is to get. Eating too little also makes you more likely to rebound and go in the opposite direction by overeating because you were restricting yourself for so long. “We. (The one exception to this in the early weeks of pregnancy – see the reasons why below.) The effect of a mom's weight gain or loss on her baby during pregnancy. Most people gain and lose a little weight from day to day, but these changes tend to stay within a five-pound range. However, if you've lost more than that. Lose Weight in 30 Days is designed for you to lose weight in a fast and safe way. Not only does it have systematic workouts, but it also provides diet plans. Drink Two Glasses of Water Before Every Meal · 9. Reduce Bloating · 8. Get at Least Eight Hours of Sleep · 7. Try an Earlier Dinner Time · 6. Avoid Processed. To look slimmer in a week, drink 2 glasses of water before each meal to help you feel full and stay hydrated. Then, cut back on dairy and white grain food, like. One of the most popular is the system. This involves 2 days a week of fasting or VLCD and 5 days a week of eating your normal diet. Diets that incorporate. Aim to lose between lb (kg) and 2lb (1kg) a week until you reach your target weight. A healthy, balanced diet and regular physical activity will help.

Can You Do A 401k On Your Own

Through a combination of elective salary deferrals and profit sharing, these plans allow participants to contribute more of their income than would be possible. Simple, low-cost, full-scale – our flexible Solo (k) plans allow self-employed individuals to maximize their retirement savings and still enjoy the same. Get answers to commonly asked questions about One Participant (k) plans (also known as Solo (k), Solo-k, Uni-k and One-participant k). An Individual(k)—also known as Individual (k)—maximizes retirement savings if you're self-employed or a business owner with no employees other than your. The difference is you act as both the employee and the employer. This distinction allows you to have much more control over your (k) than you would from an. As a small business owner, you can deduct your contributions for yourself, and your business partner from your company's federal taxable income. Your plan. If you have any self-employment income, you might be able to save in a Solo (k) (or one-person (k) plan). Many types of self-employment qualify. The solo (k) allows you to pay yourself twice, both as the employer and as the employee. The “employee” contribution you can make is limited to $22, The. A solo (k) plan may be ideal if you want to set up a retirement plan as a self-employed person. Among employer-provided plans, it has the highest. Through a combination of elective salary deferrals and profit sharing, these plans allow participants to contribute more of their income than would be possible. Simple, low-cost, full-scale – our flexible Solo (k) plans allow self-employed individuals to maximize their retirement savings and still enjoy the same. Get answers to commonly asked questions about One Participant (k) plans (also known as Solo (k), Solo-k, Uni-k and One-participant k). An Individual(k)—also known as Individual (k)—maximizes retirement savings if you're self-employed or a business owner with no employees other than your. The difference is you act as both the employee and the employer. This distinction allows you to have much more control over your (k) than you would from an. As a small business owner, you can deduct your contributions for yourself, and your business partner from your company's federal taxable income. Your plan. If you have any self-employment income, you might be able to save in a Solo (k) (or one-person (k) plan). Many types of self-employment qualify. The solo (k) allows you to pay yourself twice, both as the employer and as the employee. The “employee” contribution you can make is limited to $22, The. A solo (k) plan may be ideal if you want to set up a retirement plan as a self-employed person. Among employer-provided plans, it has the highest.

You can be an employee of a business and also be separately self-employed. In this case, you are still eligible to establish a Solo (k) for your own business. Each company has its own rules about matching, so consult with your HR department to learn how yours works. How do you open a (k)?. Do the following to open. You pay the taxes on contributions and earnings when the savings are withdrawn. As a benefit to employees, some employers will match a portion of an employee's. It depends on your own unique retirement goals and other sources of savings. You might want to aim for your annual contribution from all sources — your own. To qualify for a solo (k), you must produce your income from your own business. And the business must be run by you alone, or you and your spouse. Sole. No. If you or your spouse own a business that has W2 employees who work more than hours per year, you do not qualify for a Solo k account and the. For example, if you have a job with Google and do landscaping on the side, the two entities are completely separate, and you are allowed to start your own Solo. A self-employed (k), also known as a solo (k), can be an option for maximizing retirement savings even if you're not making a lot of money. Who can open. If you or your spouse own a business that has W2 employees who work more than per year, you do not qualify for a Solo k account and the Checkbook IRA is. Start saving for your Individual (k) today. We've got individual (k) plans for self-employed workers and small businesses for maximum retirement. You cannot set up your own (k) as an employee. The only exception to this rule is if you are self-employed, you can set up a (k) known as. If you're a self-employed professional, setting up a Solo (k) can provide you with a powerful retirement savings tool. With a Solo (k). If your solo (k) balance is above $,, you may have to file tax form EZ for one-participant plans. Also, solo (k)s typically do not provide. A solo k allows you to invest in any security or alternative investment such as real estate, private investments, private loans, metals, tax liens. The difference is you act as both the employee and the employer. This distinction allows you to have much more control over your (k) than you would from an. No. If you or your spouse own a business that has W2 employees who work more than hours per year, you do not qualify for a Solo k account. You can contribute up to $66k to your Solo (k) and take huge tax deductions. Investment Options. There's no preset menu of investments. Invest in anything. Don't worry if your employer doesn't offer a (k); there are still ways you can save for retirement on your own. Many big banks and brokerages offer. From increasing your annual retirement savings to potential tax breaks—both today and in retirement—Roth IRAs and (k)s could deliver on multiple levels when. An Individual (k) can help you defer the payment of taxes on a higher level of profits (compared to IRA-based retirement plans), as well as plan for your.

Kpti Stock Forecast

Stock Price Targets. High, $ Median, $ Low, $ Average, $ Current Price, $ Yearly Numbers. Estimates. KPTI will report earnings. Karyopharm Therapeutics (KPTI) stock price prediction is 0 USD. The Karyopharm Therapeutics stock forecast is 0 USD for July 17, Thursday with. View Karyopharm Therapeutics, Inc. KPTI stock quote prices, financial information, real-time forecasts, and company news from CNN. With an AI score of 42, the KPTI stock forecast suggests stability. What is the KPTI price prediction for ? To predict the price for KPTI in , we can. Free Karyopharm Therapeutics (KPTI) analysis tools, including analyst ratings and target price forecasts, help you make informed investment decisions. Find the latest Karyopharm Therapeutics Inc (KPTI) stock forecast, month price target, predictions and analyst recommendations. According to analysts, KPTI price target is USD with a max estimate of USD and a min estimate of USD. Check if this forecast comes true in a year. Karyopharm Therapeutics Inc KPTI:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date02/06/24 · 52 Week Low The average price target is $ with a high estimate of $7 and a low estimate of $2. Sign in to your SmartPortfolio to see more analyst recommendations. Stock Price Targets. High, $ Median, $ Low, $ Average, $ Current Price, $ Yearly Numbers. Estimates. KPTI will report earnings. Karyopharm Therapeutics (KPTI) stock price prediction is 0 USD. The Karyopharm Therapeutics stock forecast is 0 USD for July 17, Thursday with. View Karyopharm Therapeutics, Inc. KPTI stock quote prices, financial information, real-time forecasts, and company news from CNN. With an AI score of 42, the KPTI stock forecast suggests stability. What is the KPTI price prediction for ? To predict the price for KPTI in , we can. Free Karyopharm Therapeutics (KPTI) analysis tools, including analyst ratings and target price forecasts, help you make informed investment decisions. Find the latest Karyopharm Therapeutics Inc (KPTI) stock forecast, month price target, predictions and analyst recommendations. According to analysts, KPTI price target is USD with a max estimate of USD and a min estimate of USD. Check if this forecast comes true in a year. Karyopharm Therapeutics Inc KPTI:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date02/06/24 · 52 Week Low The average price target is $ with a high estimate of $7 and a low estimate of $2. Sign in to your SmartPortfolio to see more analyst recommendations.

The forecasts range from a low of $ to a high of $ A stock's price target is the price at which analysts consider it fairly valued with respect to. Based on short-term price targets offered by seven analysts, the average price target for Karyopharm Therapeutics comes to $ The forecasts range from a low. Karyopharm Therapeutics KPTI share price targets for June month are 1 on upside & on downside · Karyopharm Therapeutics Inc. · Karyopharm Therapeutics Inc. Over the last 12 months, its price fell by percent. Looking ahead, we forecast Karyopharm Therapeutics to be priced at by the end of this quarter and. KPTI | Complete Karyopharm Therapeutics Inc. stock news by MarketWatch Karyopharm Therapeutics stock price target raised to $11 from $6 at Wedbush. The Karyopharm Therapeutics Inc stock price today is What Is the Stock Symbol for Karyopharm Therapeutics Inc? The stock ticker symbol for Karyopharm. Tomorrow's movement Prediction of Karyopharm Therapeutics Inc. KPTI appears strongly Bullish. This stock started moving upwards as soon as it opened. Generally. Track Karyopharm Therapeutics Inc (KPTI) Stock Price, Quote, latest community messages, chart, news and other stock related information. Karyopharm Therapeutics (NASDAQ:KPTI) Stock, Analyst Ratings, Price Targets, Forecasts Karyopharm Therapeutics Inc has a consensus price target of $ based. KPTI Stock Overview ; Consensus estimates of losses per share improve by 43%. Aug 13 ; Price target decreased by 14% to US$ Aug 08 ; Second quarter According to our current KPTI stock forecast, the value of Karyopharm Therapeutics shares will rise by % and reach $ per share by September 3, The average Karyopharm Therapeutics stock price prediction forecasts a potential upside of % from the current KPTI share price of $ Stock Price Forecast. The 4 analysts with month price forecasts for KPTI stock have an average target of , with a low estimate of and a high. See Karyopharm Therapeutics Inc. (KPTI) stock analyst estimates, including earnings and revenue, EPS, upgrades and downgrades Analyst Price Targets. KPTI's current price target is $ Learn why top analysts are making this stock forecast for Karyopharm Therapeutics at MarketBeat. Stock Price Targets. High, $ Median, $ Low, $ Average, $ Current Price, $ Yearly Numbers. Estimates. KPTI will report earnings. Based on the share price being below its 5, 20 & 50 day exponential moving averages, the current trend is considered strongly bearish and KPTI is experiencing. The Karyopharm Therapeutics stock price is USD today. Will KPTI stock price drop / fall? Yes. The Karyopharm Therapeutics stock price may drop from The current price of KPTI is USD — it has increased by % in the past 24 hours. Watch Karyopharm Therapeutics Inc. stock price performance more. Bid Price and Ask Price. The bid & ask refers to the price that an investor is willing to buy or sell a stock. The bid is the highest amount that a buyer is.

Free Stock Tracking

![]()

SigFig offers both a free version and paid version. With this app, you can connect your accounts and then see all your assets and measure individual. TradingView provides free real-time stock charts that are visually appealing and can be customized with hundreds of technical indicators. The most comprehensive stock app in the mobile world. Brings you free streaming live quotes, pre-market/after-hour quotes, portfolio monitoring. We offer a free stock market game featuring real-time stock prices and rankings that allows users to learn about the stock markets and practice investing. Track your entire portfolio for free. Step 1 Name First name Error: Must be a valid first name. Last name Error: Must be a valid Last name. Free real-time stock quotes, news, charts, time&sales, options and more for Portfolio Tracker. Now with StockScouter® reports! Overview of the best stock market tracking apps and websites · Yahoo Finance: Best for beginners · Morningstar: Best for budget-conscious investors · Seeking Alpha. Track your personal stock portfolios and watch lists, and automatically Best Free Checking · Student Loans · Personal Loans · Insurance · Car insurance. Our free inventory tracking app makes managing inventory and monitoring stock levels much easier. Download now. SigFig offers both a free version and paid version. With this app, you can connect your accounts and then see all your assets and measure individual. TradingView provides free real-time stock charts that are visually appealing and can be customized with hundreds of technical indicators. The most comprehensive stock app in the mobile world. Brings you free streaming live quotes, pre-market/after-hour quotes, portfolio monitoring. We offer a free stock market game featuring real-time stock prices and rankings that allows users to learn about the stock markets and practice investing. Track your entire portfolio for free. Step 1 Name First name Error: Must be a valid first name. Last name Error: Must be a valid Last name. Free real-time stock quotes, news, charts, time&sales, options and more for Portfolio Tracker. Now with StockScouter® reports! Overview of the best stock market tracking apps and websites · Yahoo Finance: Best for beginners · Morningstar: Best for budget-conscious investors · Seeking Alpha. Track your personal stock portfolios and watch lists, and automatically Best Free Checking · Student Loans · Personal Loans · Insurance · Car insurance. Our free inventory tracking app makes managing inventory and monitoring stock levels much easier. Download now.

StocksTracker offers free stock charts and streaming quotes.

What to Look for in the Best Stock Market Apps · Acorns works in a similar way, but it extends even more support by making your investment automatic. · Yahoo! Keep track of all stocks spanning global markets such as Nasdaq, NYSE, Euronext, HKEX, and more. Use the free app to get the latest stock prices and market. Build and Track Your Portfolio For Free Portfolio Manager helps you make smart and better informed decisions about your investments by keeping you on top of. Set up an online portfolio (if you hold more than one stock) to help track your stocks over time. Most financial services sites and search engines offer a free. The 4 Top Portfolio Management Apps · 1. Empower (Formerly Personal Capital) · 2. SigFig Wealth Management · 3. Sharesight · 4. Yahoo! Finance. Best of all, it's free. Start here - it takes seconds. Create Portfolio. Beanvest is a free stock portfolio tracker that will allow you to get more advanced information than this portfolio tracking spreadsheet. For example, it will. A trader's rite of passage, charts power insight. Millions use ours – for free – to make better decisions in the markets. Our charts work on any device and. MarketWatch provides the latest stock market, financial and business news. Get stock market quotes, personal finance advice, company news and more. Portfolio tracking for long-term investors. We do the rest. Ready to give it a try? Evaluate your portfolio for free. The us version of webull has real time data for free. Its user friendly, clean charting, and watchlists are easy to make. They also have a. Track stocks and equity, funds, ETFs, currencies in the stock market, crypto, and unlisted equity - Real time price alerts to notify you of price changes in. It's even better than an Excel stock tracker because it's in Google Sheets. After plugging in all my historical transactions, this became my go to portfolio. Keep track of all your stocks, real estate and commodities. Analyse any stock with relevant data. Everything in real-time and % free to use. JStock makes it easy to track your stock investment. It provides well organized stock market information, to help you decide your best investment strategy. These are a few of the reasons Wealthica is one of the best stock tracking apps you can find online. When it comes to stock tracking apps, one quickly thinks. Millions of individuals have used our free online courses and stock market games to help themselves get started investing on the right track. Whether you are Stock tracker to help you track stocks, crypto, forex, and more. Track stocks with stock alerts through phone calls, text messages, emails. Ziggma's free portfolio tracker provides long term investors with a powerful toolkit to build wealth and reach their investment goals. One of the simplest ways to track your stocks is with a spreadsheet. Google sheets are a great option for collaboration and portability. Check out this free.

Can I Open Traditional Ira If I Have 401k

_into_a_Roth_IRA-1.png?width=3360&height=1890&name=Signs_to_Roll_your_401_(k)_into_a_Roth_IRA-1.png)

Individuals with earned income can open an IRA — even if they also have a (k). First, decide what type of IRA you'd like to open. A traditional IRA generally. Contributions to Roth IRAs, and Roth (k) contributions rolled over to Roth IRAs, can be accessed tax- and penalty-free at any point. If you withdraw more. You can still contribute to a Roth IRA (individual retirement account) and/or a traditional IRA as long as you meet the IRA's eligibility requirements. You. You can open an IRA at a: Brokerage firm; Mutual fund company; Insurance company; Bank or credit union. Traditional IRA. Whether your IRA contribution is tax. However, there is a limit set on the amount of money you can contribute in total to your IRAs, regardless of whether they're Roth or traditional accounts. The. Rolling over your (k) to an IRA (Individual Retirement Account) is one way to go, but you should consider your options before making a decision. Based on your situation, you can determine whether to continue adding money to your (k) and/or open an IRA. You can open an IRA at most banks and investment. Yes, no problem. However, while the k plan is not an issue to interfere with the new Roth IRA you set up, your traditional IRA and Roth IRA. You can roll over your IRA into a qualified retirement plan (for example, a (k) plan), assuming the retirement plan has language allowing it to accept this. Individuals with earned income can open an IRA — even if they also have a (k). First, decide what type of IRA you'd like to open. A traditional IRA generally. Contributions to Roth IRAs, and Roth (k) contributions rolled over to Roth IRAs, can be accessed tax- and penalty-free at any point. If you withdraw more. You can still contribute to a Roth IRA (individual retirement account) and/or a traditional IRA as long as you meet the IRA's eligibility requirements. You. You can open an IRA at a: Brokerage firm; Mutual fund company; Insurance company; Bank or credit union. Traditional IRA. Whether your IRA contribution is tax. However, there is a limit set on the amount of money you can contribute in total to your IRAs, regardless of whether they're Roth or traditional accounts. The. Rolling over your (k) to an IRA (Individual Retirement Account) is one way to go, but you should consider your options before making a decision. Based on your situation, you can determine whether to continue adding money to your (k) and/or open an IRA. You can open an IRA at most banks and investment. Yes, no problem. However, while the k plan is not an issue to interfere with the new Roth IRA you set up, your traditional IRA and Roth IRA. You can roll over your IRA into a qualified retirement plan (for example, a (k) plan), assuming the retirement plan has language allowing it to accept this.

Can I Have an IRA and a (k)? Yes, absolutely. Having both is an effective way to diversify your retirement portfolio. Financial professionals generally. Yes, you can open a Roth IRA even if you already have and contribute to a retirement plan at work, such as a (k) or (b). Determining how much to. Anyone can open and fund a traditional IRA account given the absence of income limits. However, if you're seeking tax-deductible contributions, the IRS does. A traditional IRA can help you save now with tax-deductible contributions. If you expect to have higher income in retirement, consider a Roth IRA for income tax. Yes, you can have a Roth IRA and a (k) if you're eligible for your employer's (k) plan and you qualify to contribute to a Roth IRA. Yes, you can have both a (k) and an IRA, although certain limitations apply. If you open a Traditional IRA in addition to your (k), your ability to claim. Generally, a traditional IRA has no income limit affecting pre-tax contributions, unless you (or your spouse) have a workplace retirement plan, such as a (k). Easiest way to build a trad IRA is with a Rollover IRA. Normally when switching jobs, you can either take your old k to your new job k. Or. If you meet the requirements, though, you could theoretically open as many IRAs as you'd like—traditional and/or Roth. These IRAs can also complement any (k). You can save more by contributing the maximum to each account. · You can utilize tax advantages, especially if one of those accounts is a Roth. · You can maximize. You can contribute to an IRA even if you also have a (k), with some income limits. Roth IRA contributions are limited by your income. 1. You may be able to contribute to an IRA, even if you have a (k) · 2. Your income could be too high for a Roth IRA · 3. Your tax deduction for traditional. In the general sense, contributing to a k does not factor to IRAs. You probably need to do backdoor Roth IRA. A K is a type of employer retirement account. An IRA is an individual retirement account. File with H&R Block to get your max refund. File online. You can keep contributing as long as you or your spouse is earning income. If I participate in a workplace retirement plan, does it make sense to contribute to. IRA stands for individual retirement account. · If you're eligible, you can contribute to both a Roth and traditional IRA in the same year—though you can only. Contribute to a traditional or Roth IRA. You can contribute to an IRA even if you, or your spouse, are already contributing the maximum to a (k), (b). Can I roll my (k) into an IRA? Yes. If you have assets in a (k) with an employer that you no longer work for, you can roll over these assets. You can. You can contribute to a traditional or Roth IRA even if you participate in another retirement plan through your employer or business. However, you may not be. If your spouse doesn't work, they can have a spousal IRA. This allows non-wage-earning spouses to contribute to their own traditional or Roth IRA, provided the.

What Companies Make Up The Nasdaq 100

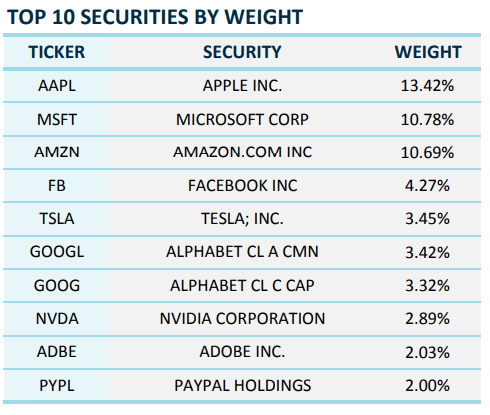

Stocks ; 60, DASH, DoorDash, Inc. ; 61, AEP, American Electric Power Company, Inc. ; 62, ROST, Ross Stores, Inc. ; 63, TTD, The Trade Desk, Inc. The Fund seeks to distribute high monthly income generated from investing in the constituents of the Nasdaq® Index and implementing a data-driven call. NASDAQ ; TMUS. T-Mobile US Inc, ; VRSK. Verisk Analytics Inc, ; VRTX. Vertex Pharmaceuticals Inc, ; WBD. Warner Bros Discovery Inc, View the basic ^NDXT stock chart on Yahoo Finance and learn which stocks are present under NASDAQ Technology Sector (^NDXT). The NASDAQ is known to list stocks from technology companies. Some of the major stocks trading on the NASDAQ include Amazon, Alphabet (Google), Facebook. The Nasdaq is an index which includes of the world's largest non-financial companies listed on the broader Nasdaq sharemarket, based on their market. Free Stock Quotes Nasdaq Amex NYSE, Options and Mutual Funds, Investment information, Portfolio Tracking, Ticker. It is made up of of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization. Composition of the Nasdaq Index · Apple Inc. (%) · Microsoft (%) · NVIDIA (%) · Amazon (%) · Meta Platforms (%) · Broadcom (%) · Google (A. Stocks ; 60, DASH, DoorDash, Inc. ; 61, AEP, American Electric Power Company, Inc. ; 62, ROST, Ross Stores, Inc. ; 63, TTD, The Trade Desk, Inc. The Fund seeks to distribute high monthly income generated from investing in the constituents of the Nasdaq® Index and implementing a data-driven call. NASDAQ ; TMUS. T-Mobile US Inc, ; VRSK. Verisk Analytics Inc, ; VRTX. Vertex Pharmaceuticals Inc, ; WBD. Warner Bros Discovery Inc, View the basic ^NDXT stock chart on Yahoo Finance and learn which stocks are present under NASDAQ Technology Sector (^NDXT). The NASDAQ is known to list stocks from technology companies. Some of the major stocks trading on the NASDAQ include Amazon, Alphabet (Google), Facebook. The Nasdaq is an index which includes of the world's largest non-financial companies listed on the broader Nasdaq sharemarket, based on their market. Free Stock Quotes Nasdaq Amex NYSE, Options and Mutual Funds, Investment information, Portfolio Tracking, Ticker. It is made up of of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization. Composition of the Nasdaq Index · Apple Inc. (%) · Microsoft (%) · NVIDIA (%) · Amazon (%) · Meta Platforms (%) · Broadcom (%) · Google (A.

The NASDAQ is a stock market index made up of of the most traded and largest US tech companies, including Google and Apple. Learn more. The NASDAQ Index constituents can be found in the table below. Sort NDX stock components by various financial metrics and data such as performance. The NASDAQ Index includes of the largest domestic and international non-financial companies listed on The NASDAQ. Stock Market based on market. Micro Nasdaq E-mini futures contracts provide an ideal entry point for new futures traders to start small and scale up as you become more comfortable in the. Adobe Inc. ADP (company) · Airbnb · Alphabet Inc. Amazon (company) · AMD · American Electric Power · Amgen · Analog Devices · Ansys. CNBC Newsletters. Sign up for free newsletters and get more CNBC delivered to your inbox. Sign Up Now make available with data across different. stock positions to provide an attractive alternative to single-stock covered call writing. 5-Year Beta and Correlation: Top 20 NASDAQ Index Constituents3. Components ; Cintas, CTAS, Industrials ; Cisco, CSCO, Information Technology ; Coca-Cola Europacific Partners, CCEP, Consumer Staples ; Cognizant, CTSH, Information. Build Your Watchlist. Personalize and monitor market data with your custom tool. Register Now. SymbolPrice/Vol%Chg. DJIA · Dow Jones Industrial Average. Constituents · Costs and details · Related markets. MICROSOFT CORPORATION · Stock Microsoft Corporation. ; APPLE INC. Stock Apple Inc. ; NVIDIA CORPORATION · Stock NVIDIA Corporation. ; AMAZON. NASDAQ STOCKS ; Amgen, , ; Analog Devices, , ; ANSYS, , ; Apple, Nasdaq Components · Intel. |INTC · Microsoft. |MSFT · Cisco. |CSCO · Kraft Heinz. |KHC · Vertex. |VRTX · Monster. Apple · Microsoft · Alphabet · Amazon · Facebook · Paypal · Adobe; Peloton; Tesla. Constituents are chosen for inclusion according to strict criteria. They need. company's specific business involvement. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market. How many companies are in the Nasdaq? · Apple (AAPL %) · Microsoft (MSFT %) · Amazon (AMZN %) · Nvidia (NVDA %) · Tesla (TSLA %) · Alphabet (C. Get to know the Nasdaq® · Cognizant Inc. Cognizant, based in Teaneck, New Jersey, has solidified its status as a professional services company at the. The Corporations make no representation or warranty, express or implied to NASDAQ Investor can tolerate losses (up to the total invested amount). The 10 largest Nasdaq companies comprise more than 48% of the index's market capitalization. These companies span multiple sectors, with information. The Nasdaq is a stock market index made up of equity securities issued by of the largest non-financial companies listed on the Nasdaq stock exchange.

Dental Insurance Plans Illinois

Searching for affordable dental insurance in Illinois? Compare IL dental plans and insurance, and find options that can save you between 10%%. Delta Dental offers a range of dental insurance plans tailored to individuals and families in Illinois. Their plans are made to provide comprehensive coverage. Shop our affordable PPO and Premier dental insurance plans designed for Illinois individuals and families. Find the best dental coverage. That is why Blue Cross and Blue Shield of Illinois (BCBSIL) offers BlueCare Dental Classic℠. Our dental insurance plans provide you with savings on preventive. Shop affordable individual & group dental insurance plans from America's largest and most trusted dental insurance carrier. The BCBS of IL Dental PPO (formerly Dearborn Dental) is a dental plan covering comprehensive care for members. Plan benefits; Monthly premiums; Find a dentist. We make it easy to find an affordable plan, including options that bundle vision and hearing coverage. Our plans start from around $1 a day. With no waiting period for preventive dental care, and for basic and major procedures when you switch plans, our PPO plan offers immediate dental coverage. Affordable plans. Plan options start at $ And your dental checkups, cleanings and X-rays are % covered. Searching for affordable dental insurance in Illinois? Compare IL dental plans and insurance, and find options that can save you between 10%%. Delta Dental offers a range of dental insurance plans tailored to individuals and families in Illinois. Their plans are made to provide comprehensive coverage. Shop our affordable PPO and Premier dental insurance plans designed for Illinois individuals and families. Find the best dental coverage. That is why Blue Cross and Blue Shield of Illinois (BCBSIL) offers BlueCare Dental Classic℠. Our dental insurance plans provide you with savings on preventive. Shop affordable individual & group dental insurance plans from America's largest and most trusted dental insurance carrier. The BCBS of IL Dental PPO (formerly Dearborn Dental) is a dental plan covering comprehensive care for members. Plan benefits; Monthly premiums; Find a dentist. We make it easy to find an affordable plan, including options that bundle vision and hearing coverage. Our plans start from around $1 a day. With no waiting period for preventive dental care, and for basic and major procedures when you switch plans, our PPO plan offers immediate dental coverage. Affordable plans. Plan options start at $ And your dental checkups, cleanings and X-rays are % covered.

Find a Guardian dental insurance plan in Illinois. We offer plans directly or through the healthcare marketplace that fit your budget and coverage needs. If a health plan includes dental, the premium covers both health and dental coverage. Separate dental plans: In some cases, separate dental plans are offered. Indemnity dental plans are plans that allow you to go to any dentist you want, there are no networks. There is a catch though, because you are able to go to any. Say yes to big savings with the Dental Plan from Illinois Retired Teachers Association and AMBA. This plan covers everything from routine checkups to. Illinois dental insurance plans typically cover preventative exams, routine teeth cleaning, fillings, and x-rays. Some plans cover periodontics, endodontics. Dental Insurance Information · Aetna · Assurant · Blue Cross Blue Shield · Carington · Cigna · Connection Dental (GEHA) · Delta Dental – Premier Plan · Dental Health. Delta Dental of Illinois is a dental and vision insurance company that offers individual and family plans. They provide resources and knowledge on. Members get extras like coverage for mouthguards and implants, as well as cosmetic benefits like teeth whitening and veneers. This plan also includes additional. At EasyDentalQuotes, we are privileged to supply Illinois residents with access to affordable Illinois dental insurance. We work with top carriers such as. Delta Dental of Illinois is the administrator for this plan. Eligibility. To be eligible for SEGIP dental insurance benefits, you must meet the following. Illinois dental insurance guide. The health insurance Marketplace in Illinois has certified individual and family dental plans from seven insurers. The Quality Care Dental Plan (QCDP) is administered by Delta Dental of Illinois. Plan participants enrolled in the dental plan can choose any dental provider. As a Blue Cross Community Health Plans (BCCHP) member, you receive dental coverage. BCCHP works with DentaQuest to provide you with dental care. The Local Care Dental Plan (LCDP) is a dental plan that offers a comprehensive range of benefits. All plan participants have the same dental benefits available. Dental and Vision Insurance Plans are provided by Blue Cross and Blue Shield of Illinois. No waiting period for Basic Services. Dental PlansDental coverage is provided at no charge. The dental plans offer two dental exams and cleanings per year. Your employees can now purchase stand-alone dental coverage. Blue Cross and Blue Shield of Illinois (BCBSIL) has available plans to allow employers to offer. CB Health Insurance has been providing specialized Illinois dental insurance protection for individuals, the self-employed and business owners for many years. Many types of dental plans provide coverage for services and treatments that go well beyond preventive care. These are considered full coverage. Dental PPO . Illinois Dental Insurance Plan Comparison ; Annual Max per Person (age 19 and older), $1,, $1,

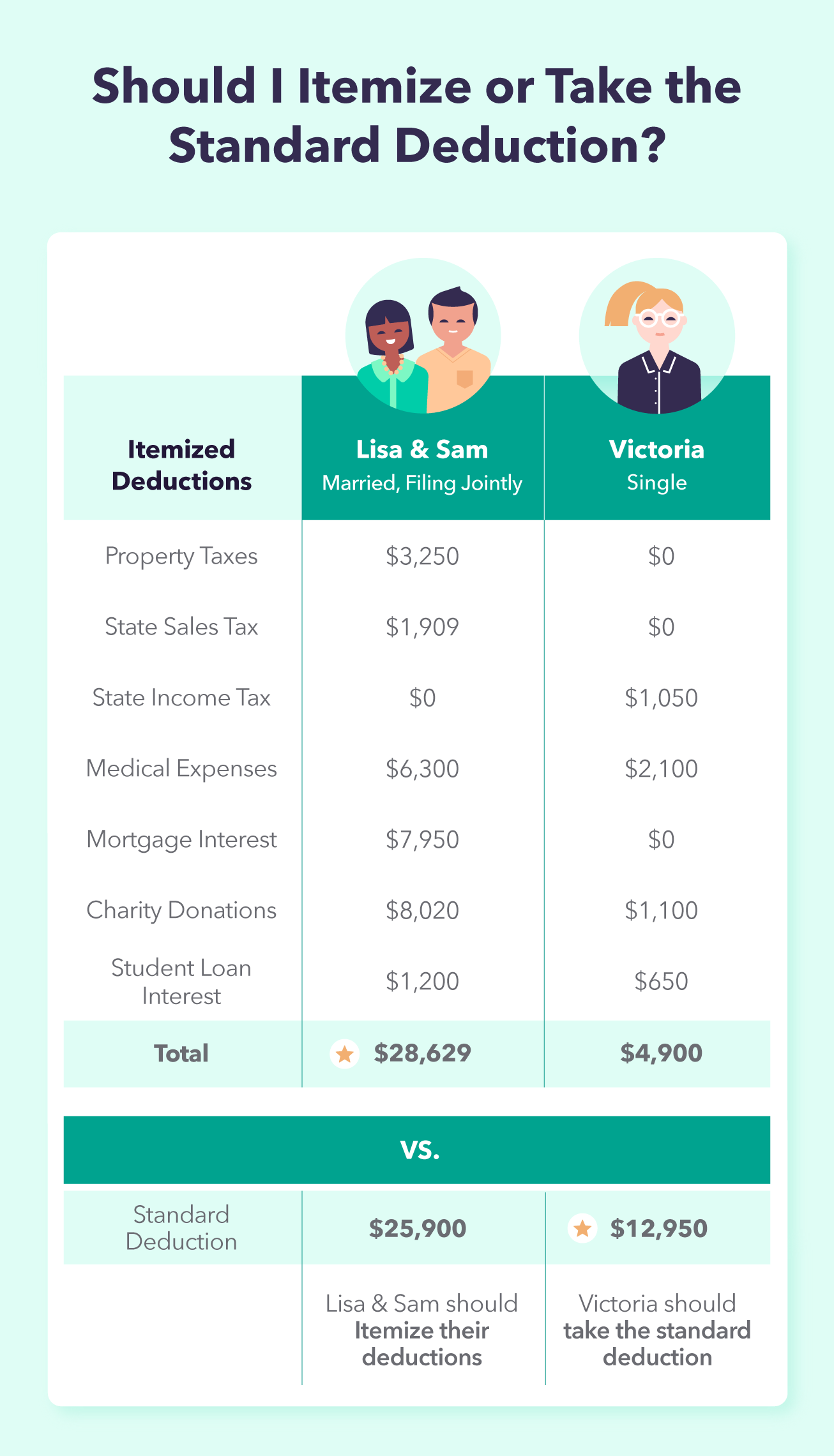

What Counts As A Tax Deduction

A tax-deductible business expense is any cost incurred by an organization that can be subtracted from its taxable income, thereby reducing its tax liability. For the tax year, seniors filing single or married filing separately get a standard deduction of $14, For those who are married and filing jointly, the. What doesn't count as a tax deduction? · Car inspection fees · Customs duties · Employee business expenses (eliminated in tax law) · Federal excise tax. Not every mile counts as a tax deduction. The following are eligible for tax deductions: Miles driven to pick up passengers; Miles driven with a passenger in. Counting your IRA contributions as tax deductions depends on the type of IRA you invest in, the retirement plan your employer offers, and your income. Roth IRA. Employers withhold (or deduct) some of their employees' pay in order to cover payroll taxes and income tax. Money may also be deducted, or subtracted, from. Common itemized deductions include medical and dental expenses, state and local taxes, mortgage interest, charitable contributions, unreimbursed job expenses. How to claim deductions · Cars, transport and travel · Tools, computers and items you use for work · Clothes and items you wear at work · Working from home expenses. The actual savings of tax deductions can vary greatly depending on what business expenses you incurred that year. However, you can count on write-offs for rent/. A tax-deductible business expense is any cost incurred by an organization that can be subtracted from its taxable income, thereby reducing its tax liability. For the tax year, seniors filing single or married filing separately get a standard deduction of $14, For those who are married and filing jointly, the. What doesn't count as a tax deduction? · Car inspection fees · Customs duties · Employee business expenses (eliminated in tax law) · Federal excise tax. Not every mile counts as a tax deduction. The following are eligible for tax deductions: Miles driven to pick up passengers; Miles driven with a passenger in. Counting your IRA contributions as tax deductions depends on the type of IRA you invest in, the retirement plan your employer offers, and your income. Roth IRA. Employers withhold (or deduct) some of their employees' pay in order to cover payroll taxes and income tax. Money may also be deducted, or subtracted, from. Common itemized deductions include medical and dental expenses, state and local taxes, mortgage interest, charitable contributions, unreimbursed job expenses. How to claim deductions · Cars, transport and travel · Tools, computers and items you use for work · Clothes and items you wear at work · Working from home expenses. The actual savings of tax deductions can vary greatly depending on what business expenses you incurred that year. However, you can count on write-offs for rent/.

Employers withhold (or deduct) some of their employees' pay in order to cover payroll taxes and income tax. Money may also be deducted, or subtracted, from. It increased the standard deduction amounts for well beyond what they would have been in that year, raising the deduction from $6, to $12, for. The D commercial buildings energy-efficiency tax deduction enables building owners to claim a tax deduction for installing qualifying systems. When you donate cash an IRS-qualified (c)(3) public charity, you can generally deduct up to 60% of your adjusted gross income. A tax deduction is a provision that reduces taxable income, as an itemized deduction or a standard deduction that is a single deduction at a fixed amount. constitutes an illegal bribe or kickback or, if the payment is to an (4) Deduction not allowed for self-employment tax purposes. The deduction. Rent paid for mobile homes and for land use for mobile homes qualifies for this deduction individual income tax returns, some property tax relief for rent. A tax deduction or benefit is an amount deducted from taxable income, usually based on expenses such as those incurred to produce additional income. Equipment can range from heavy machinery like backhoes to computers and certain software programs for your business. What kind of equipment qualifies under. It was nearly doubled for all classes of filers by the Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing. A tax deduction reduces the amount of income that is subject to taxation by federal and state governments. Find the current list of tax deductions for. Tax deduction lowers a person's tax liability by reducing their taxable income. Because a deduction lowers your taxable income, it lowers the amount of tax you. This policy qualifies under the Indiana Long Term Care Program for Medicaid asset protection. Residential Homeowner's Property Tax Deduction. Details. You may. What are examples of payroll deductions? · Pre-tax deductions: Medical and dental benefits, (k) retirement plans (for federal and most state income taxes). If the aggregate amount of the SALT payments exceeds $10, such that the taxpayer cannot deduct the full amount of SALT payments on the federal tax return. The amount of the deduction is the lesser of $5, or the actual amount paid by the taxpayer. If filing a joint return, the deduction is limited to $10, or. It increased the standard deduction amounts for well beyond what they would have been in that year, raising the deduction from $6, to $12, for. Tax Deductions for Commercial Buildings · Tax Credit Information · Definitions You purchase an air-source heat pump that qualifies for the energy efficient. If the aggregate amount of the SALT payments exceeds $10, such that the taxpayer cannot deduct the full amount of SALT payments on the federal tax return. Washington State residents may deduct state and local general-sales tax on their federal income returns for tax year and succeeding tax years.