lsvtc.ru

Tools

Popular Stocks Under 100

Top 20 Stocks Under Rupees ; Punjab National Bank. Public Banks. 1,12, ; IDBI Bank Ltd. Private Bank. 90, ; NHPC Ltd. Renewable Energy. 80, Here are the latest stock price details of India's top Power stocks. For more detailed updates, read our Power sector report and check the latest Power sector. stocks under ; 1. IDBI Bank, , , ; 2. IDFC First Bank, , , A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on. Complete list of the Best NASDAQ stocks under $1 in , with average daily volume over Find active penny stocks now. Updated daily. Best Low Price Shares Under Rs. 10 () Based on 5Y Average Net Profit Margin ; S V Trading and Agencies Ltd, ₹, ₹ ; Sri Amarnath Finance Ltd, ₹ Stocks Under $10 ; SmartKem Inc SMTK · $5 ; Outlook Therapeutics Inc OTLK · $ ; Vaccinex Inc VCNX · $ ; Baiyu Holdings Inc BYU · $ ; Sidus Space Inc - Ordinary. The top stocks priced under $10 represent potential opportunities for companies outpacing the market. My advice is to just buy what you normally put your money towards (knowing it's a popular company many people utilize). I invest. I'm not good. Top 20 Stocks Under Rupees ; Punjab National Bank. Public Banks. 1,12, ; IDBI Bank Ltd. Private Bank. 90, ; NHPC Ltd. Renewable Energy. 80, Here are the latest stock price details of India's top Power stocks. For more detailed updates, read our Power sector report and check the latest Power sector. stocks under ; 1. IDBI Bank, , , ; 2. IDFC First Bank, , , A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on. Complete list of the Best NASDAQ stocks under $1 in , with average daily volume over Find active penny stocks now. Updated daily. Best Low Price Shares Under Rs. 10 () Based on 5Y Average Net Profit Margin ; S V Trading and Agencies Ltd, ₹, ₹ ; Sri Amarnath Finance Ltd, ₹ Stocks Under $10 ; SmartKem Inc SMTK · $5 ; Outlook Therapeutics Inc OTLK · $ ; Vaccinex Inc VCNX · $ ; Baiyu Holdings Inc BYU · $ ; Sidus Space Inc - Ordinary. The top stocks priced under $10 represent potential opportunities for companies outpacing the market. My advice is to just buy what you normally put your money towards (knowing it's a popular company many people utilize). I invest. I'm not good.

List of Intraday Shares Under Rs ; NHPC. N · NHPC. B S · , %, 5,26,36,, ₹ 96, ; IDFC First Bank. I. IDFC First Bank. B S · , %, 3, As the name suggests, these stocks are often priced under $2 per share — making them much more accessible to new penny stock investors or those with less. Here is list of Top Stocks Under Rs in India in are: 1. SavenTech, 2. Family Care, 3. Dolat Algotech, 4. BPCL Railway, 5. Bliss GVS Pharma, 6. Best Stocks Under ₹ Explore the Best Stock Under Rs in India to Buy in Get Insights on Share Prices and Market Cap. Start Investing in Shares. Shares Under Rs: Check out the list of stocks to buy under Rs that are likely to turn profitable and start investing only at 5paisa. Nasdaq · Symbol Screener · Online Brokers · Glossary · Sustainable Bond 1 Top Space Stock You Need to Know About Before a Key Launch in September 1. The most active Canadian stocks in the market can be found below. Companies are sorted by daily volume and supplied with other stats to help you find out why. List of the top stocks worldwide · 1 AAPL. Copied to clipboard. T USD, 0 USD, —. 2. Microsoft Stock · 2 MSFT. Copied to clipboard. T USD, 0 USD, —. 3. Based on popular stocks. Sep. 5. Broadcom Inc. Sep 5, , PM 3 Details That Went Under the Radar. Barron's • 8 hours ago. INTC · Intel Corp · Intel. BSE LargeCap TMC · BSE DFRG · BSE PRIVATE BANK · BSE Services. NSE. All Stocks Below Previous Lows · Gap Up · Gap Down · Dark Cloud Cover · Piercing Line. Stocks under dollars: Daily Price Predictions of Stocks with Smart Technical Market Analysis. Overview of Stocks Under Rs · Suzlon Energy Ltd · GMR Infrastructure Ltd · UCO Bank · IDFC First Bank LTD · Bank of Maharashtra · Motherson Sumi Wiring India Ltd. Shares Under Rs: Check out the list of stocks to buy under Rs that are likely to turn profitable and start investing only at India Infoline. Upgrade to Unlock Every Stock Score. Upgrade to Premium. Best Stocks Under. 75 50 35 20 10 5 2 1. Market Cap [$Bn]. 0 B 1T+. 10B. 1T+. Sector. (all). High growth stocks under ₹ ; 5. JP Power Ven. ; 6. Powergrid Infra. ; 7. IRB InvIT Fund, ; 8. Jagran Prakashan, Why are you looking specifically for stocks under $? It's so easy to buy fractional shares now. No need to limit yourself to stocks with. stocks traded during the day at NSE and sort them by particular index at Groww. Check details of high volume shares in today's stock market. Popular Stocks; Indices; IPO Similarly, 52 week low BSE stocks are those stocks listed under BSE that have breached their previous lowest price point. The best cheap stocks to buy ; Alight (ALIT), $, ; Amcor (AMCR), $, ; Arcadium Lithium (ALTM), $, ; Kosmos Energy (KOS), $, under applicable laws, please contact us here: Privacy Web Form (onetrust popular and see how visitors move around the site. All information these.

Project Financing Non Recourse

We offer off-balance sheet, non-recourse loans to finance large commercial, industrial, utility and infrastructure development projects worldwide. Monetize SBLC/BG to obtain a non recourse loan. Monetizer gives a non-recourse loan against the SBLC/BG from the applicant borrower. SBLC is the collateral. Non-recourse loans are most favorable to borrowers because they put the majority of the risk and responsibility on the lender. Non-recourse financing is a type of loan where the lender is only entitled to repayment from the profits of the project the loan is funding. In the case of non-recourse financing, the project company is generally a limited liability special purpose project vehicle, and so the lenders' recourse will. Non-recourse finance, a loan where the lender is only entitled to repayment from the profits of the project the loan is funding, not from other assets of the. Non-recourse loans provide borrowers with a unique opportunity to secure financing for significant projects while limiting their personal financial exposure. In business, "non-recourse financing" typically refers to project financing. Project finance is the process of securing money for long-term projects rather than. Non-Recourse Project Funding is a financing arrangement commonly used for large-scale infrastructure projects, such as toll roads, bridges, power plants, and. We offer off-balance sheet, non-recourse loans to finance large commercial, industrial, utility and infrastructure development projects worldwide. Monetize SBLC/BG to obtain a non recourse loan. Monetizer gives a non-recourse loan against the SBLC/BG from the applicant borrower. SBLC is the collateral. Non-recourse loans are most favorable to borrowers because they put the majority of the risk and responsibility on the lender. Non-recourse financing is a type of loan where the lender is only entitled to repayment from the profits of the project the loan is funding. In the case of non-recourse financing, the project company is generally a limited liability special purpose project vehicle, and so the lenders' recourse will. Non-recourse finance, a loan where the lender is only entitled to repayment from the profits of the project the loan is funding, not from other assets of the. Non-recourse loans provide borrowers with a unique opportunity to secure financing for significant projects while limiting their personal financial exposure. In business, "non-recourse financing" typically refers to project financing. Project finance is the process of securing money for long-term projects rather than. Non-Recourse Project Funding is a financing arrangement commonly used for large-scale infrastructure projects, such as toll roads, bridges, power plants, and.

Intrepid Private Capital Group offers non-recourse loans for projects that are clearly of a humanitarian nature. () Nonrecourse financing is debt where the loan is completely secured by collateral, which is often real estate. In case of default, the borrower is not liable. Funding a construction project · Infrastructure financing · Project finance and real estate finance · Resolution, restructuring and insolvency. Practice note. Preference for stable debt service coverage throughout the life of the project loan. Page 2. 2. Security and Guarantee. Project Contracts. A non-recourse loan is one in which the lender cannot go after more than the collateral offered for the loan. This type of loan is beneficial for the borrower. They are most commonly non-recourse loans, which are secured by the project assets and paid entirely from project cash flow, rather than from the general assets. A nonrecourse debt (loan) does not allow the lender to pursue anything other than the collateral. For example, if a borrower defaults on a nonrecourse home loan. Nonrecourse debt or a nonrecourse loan is a secured loan (debt) that is secured by a pledge of collateral, typically real property, but for which the. Corporate lending · Funding a construction project · Infrastructure financing · Project finance and real estate finance · Resolution, restructuring and. Recourse loan allows the lender to seek repayment beyond the collateral while a non-recourse loan limits the lender's claim to the collateral only. We are a Premium Project Funding Placement firm that works directly with established Private Capital Sources, without any intermediaries or agent chains. Define Non-recourse Project Financing. means any Indebtedness incurred in connection with the financing of all or part of the costs of the acquisition. A non-recourse loan is a loan secured by collateral, which is usually some form of property. If the borrower defaults, the issuer can seize the collateral. Rss couldn't load any articles with the topic of non-recourse financing. Our lender does NOT charge a Success Fee for their services but will INVEST a 40% equity interest in the project instead. In other words, the borrower will. A loan secured by a charge on specific assets or on the revenues generated from a specific project or assets. Non-recourse loans are the opposite of recourse loans, which allow a lender to seize and sell a borrower's personal property. Project finance is a sort of non-recourse financing structure. This means that sponsors will often have recourse solely to assets owned by the. The lender of a non-recourse loan is only entitled to repayment from specific assets and cash flows. Limited recourse debt gives the lender a limited amount. A non-recourse loan is one where only the project financed is responsible for generating the income to repay the loan.

Walmart Moneymart

Walmart 2 Walmart and Walmart 2 World powered by Ria Money Transfer. Booklein Books & News Inc. Euclid Ave, Brown's Money Mart, Storer Ave, Check Cashing -. With convenient operating hours from 6 am and an accessible location at Wards Rd, Lynchburg, VA , it's easier than ever to receive the help you need. Told me it's dollars to cash your check. Don't go here you're better off going to Walmart. Read more on Yelp. Photo of Greg M. Greg M. 10/21/ Love. While being employed at Walmart and the other employers listed below I really learned how to have excellent customer service and also how to deal with. Money Mart royalty-free images. 2, money mart stock photos, vectors, and Hamilton, Canada - March 24, The front of a Walmart Superstore is. Money can be added to Walmart MoneyCards via direct deposit, Walmart store reload, online transfer, or tax return deposit. Here are those methods in more. 1. The post office · 2. Convenience stores · 3. Check-cashing stores · 4. Western Union · 5. MoneyGram locations · 6. Your bank or credit union · 7. Walmart. Money Network Service for ADP. For Cardholders. Money Network Service · Money Network Service for Walmart · Money Network Service for ADP. Walmart 2 Walmart and Walmart 2 World powered by Ria Money Transfer. Booklein Books & News Inc. Euclid Ave, Brown's Money Mart, Storer Ave, Check Cashing -. With convenient operating hours from 6 am and an accessible location at Wards Rd, Lynchburg, VA , it's easier than ever to receive the help you need. Told me it's dollars to cash your check. Don't go here you're better off going to Walmart. Read more on Yelp. Photo of Greg M. Greg M. 10/21/ Love. While being employed at Walmart and the other employers listed below I really learned how to have excellent customer service and also how to deal with. Money Mart royalty-free images. 2, money mart stock photos, vectors, and Hamilton, Canada - March 24, The front of a Walmart Superstore is. Money can be added to Walmart MoneyCards via direct deposit, Walmart store reload, online transfer, or tax return deposit. Here are those methods in more. 1. The post office · 2. Convenience stores · 3. Check-cashing stores · 4. Western Union · 5. MoneyGram locations · 6. Your bank or credit union · 7. Walmart. Money Network Service for ADP. For Cardholders. Money Network Service · Money Network Service for Walmart · Money Network Service for ADP.

Send money internationally or domestically with Walmart money transfer services by Western Union. Send money online, over the phone, or in person at. Mobile. Get Directions; Address; Details. WALMART Free Check Cashing RIVERPOINT CT WEST SACRAMENTO, CA miles Money Network Privacy Policy. Popular Check Cashing Services in the USA. ACE Cash Express Check Cashing, Check Into Cash Check Cashing. Money Mart Check Cashing, Walmart Money Center Check. Find locations near you where you can cash Money Mobile. Get Directions; Address; Details. WALMART Free Check Cashing RIVERPOINT CT WEST SACRAMENTO, CA. Quickly and reliably transfer money online and pickup anywhere in the US and inside Walmart stores, or internationally wherever you see the MoneyGram sign. GET money orders, SEND money transfers and PAY bills at this MoneyGram® location inside WAL-MART - # on NORMANDIE AVE in Torrance, CA. You can use a Out of State ID (That is yours, and is valid) to pickup money at any US walmart. The Sender has to tell Walmart where in the US . RF 2J3TH8K–The front of a Walmart Superstore is pictured at night, their famous slogan Save Money, Live Better is seen on the side of the building. heart_plus. Walmart Wells Fargo. Cash America Logo. Cash America. Unclaimed. Cash America provides specialty financial services to individuals in the United States at more. Handle all your financial transactions at you local Santa Ana, CA Walmart MoneyCenter. Save Money, Live Better. Handle all your financial transactions at you local Pearl City, HI Walmart MoneyCenter. Save Money, Live Better. I went to Walmart to get a refund and they said I have to wait 10 days before they can process the refund. Walmart will hold a Walmart-to-Walmart money transfer for 60 days from the date of the transaction. After this period, if the money is not. 03/ to 02/ Money Center Cashier / Customer Service Associate Wal-Mart | City, STATE, Walmart. Miami, Florida. Money Center Cashier/ customer. They are a rip off. Told me it's dollars to cash your check. Don't go here you're better off going to Walmart. If you think you can also pick up a public SIM card at your local walmart next time when you go for grocery, you are wrong! I have tried to purchase. To get money off Cash App at Walmart without card, follow these steps Step 1: Link Your Bank Account to Cash App Step 2: Enable Cash App. Money Network Checks are cashed for free. Walmart Supercenter (Green Dot° Reload @ the Register™) Cash Reload Network CHAMBLEE TUCKER. Walmart, Brookdale Centre, Brookdale Plaza, Walmart, Pitt & Second. p.m., 12 Shoppers Drug Mart; Fullerton Drug Store; Baxtrom's Independent Grocer.

Public Vs Private Reit

Public REITs generally go after stable Class A, cash-flowing properties. Private equity real estate funds can often pursue more Class B or C properties with. A non-traded REIT refers to a real estate investment trust (REIT) that is not listed and traded on a public exchange. Non-traded REITs allow investors to access. Private REIT s are not listed on public stock exchanges; therefore, they are considered private investments. Their units are purchased through the exempt market. Private REITs are not traded on a public stock exchange and not required to file a prospectus with the Securities Exchange Commission. Additionally, there are. Private REITs are often overlooked by investors as too risky due to their lack of disclosure in comparison to their public counterparts. In truth, a well-. Not Listed: Shares of private REITs are not listed on a public exchange such as the New York Stock Exchange (“NYSE”). This means their shares are not directly. While publicly traded REITs are subjected to stock market valuations, private REITs are largely immune to the same forces, making private REITs less volatile. Like stocks, the price of public REIT shares is based on the last trade executed during trading hours. Private CRE funds are valued periodically (usually. Public REITs have historically paid dividend yields in the 5%–6% range, on average, while private REIT dividend yields have historically been in the 7%–8%. Public REITs generally go after stable Class A, cash-flowing properties. Private equity real estate funds can often pursue more Class B or C properties with. A non-traded REIT refers to a real estate investment trust (REIT) that is not listed and traded on a public exchange. Non-traded REITs allow investors to access. Private REIT s are not listed on public stock exchanges; therefore, they are considered private investments. Their units are purchased through the exempt market. Private REITs are not traded on a public stock exchange and not required to file a prospectus with the Securities Exchange Commission. Additionally, there are. Private REITs are often overlooked by investors as too risky due to their lack of disclosure in comparison to their public counterparts. In truth, a well-. Not Listed: Shares of private REITs are not listed on a public exchange such as the New York Stock Exchange (“NYSE”). This means their shares are not directly. While publicly traded REITs are subjected to stock market valuations, private REITs are largely immune to the same forces, making private REITs less volatile. Like stocks, the price of public REIT shares is based on the last trade executed during trading hours. Private CRE funds are valued periodically (usually. Public REITs have historically paid dividend yields in the 5%–6% range, on average, while private REIT dividend yields have historically been in the 7%–8%.

Pros and Cons of Public REIT investing · 1. Diversification- public REITs offer diversification and lower risk for your overall portfolio. · 2. Reduced. 3. Investments in public REITs are generally more liquid than investments in private real estate. Private real estate funds can generate both impressive income. Liquidity in a publicly traded REIT is high – investors can gain access to their capital by simply selling shares of the stock. In a non-traded REIT, investors. Returns · Listed equity REITs had the third highest average annual net return over the period, %. · Unlisted real estate produced average net returns of %. There are three main types of REITs, public, non-traded, and private. Non-traded REITs are similar to publicly traded REITs, but are not listed on. REIT Out-Performance Versus Private Real Estate Funds On a related note, it is important to recognize the difference in compensation structures between public. On average, REITs will get $ of every dollar invested while Private Placements will get $+ of capital into the asset. With Private Placements generally. Public REITs have a regulatory requirement set by the Securities and Exchange Commission (SEC) that requires the REIT to distribute at least 90% of taxable. Market Scrutiny – Private/nontraded REITs are generally not subject to the same level of public disclosure as REITs traded on traditional stock exchanges. The. The biggest difference for many investors is the tax treatment. Your tax form from a REIT investment will be a DIV. Your tax form from a Private Real. While non-traded REITs are required to register with and be regulated by the Securities and Exchange Commission (SEC), private REITs are not. Both REITs are not. Private REITs are real estate funds or companies that are exempt from SEC registration and whose shares do not trade on national stock exchanges. Private REITs. Pros and Cons of Public REIT investing · 1. Diversification- public REITs offer diversification and lower risk for your overall portfolio. · 2. Reduced. REITs can either be publicly traded or offered as private placement investments to accredited investors. Non-publicly traded REITs are illiquid investments with. When public fund is down more than private fund, you invest in public. When private fund catches up and also corrects, you invest in private. There are two kinds of REITs in this category: private REITs and public non-listed REITs (PNLRs). Let's start with private REITs. These differ from public REITs. institutional investors like public pension funds will compare implied cap rates of public REITs with cap rates of private real estate. The following. While funds used in this index have characteristics that differ from net asset value real estate investment trusts (NAV REITs), which include differing. eg REITs are typically a better fit for more core assets while a fund structure would better for more transitional value add and opportunistic. Private – Shares of private REITs are generally sold to institutional investors and aren't listed on the national securities exchange or registered with the SEC.

How Can I Sell Merchandise Online

Opening your own Shop with Spreadshirt add a no-risk, no-fee, no-worries merchandising solution to your business mix. It gives you the ability to style your. Conversion campaigns include goals like add to carts, online sales and offline sales. They're great for brands that don't have a product feed or want more. How to Sell Products Online · 1. Find your products · 2. Identify your niche market · 3. Conduct market research · 4. Create buyer personas · 5. Brand your. Should I Sell Products Online? · Pros · - You'll introduce large audiences to your products. E-commerce sites let you sell products to people worldwide. · - You. To know what popular products to sell online, check Amazon reviews. You will get a first-hand look into what people love or hate about a product. For example. Yes you can sell products without actually having it with you. But you need to have proper link and contact with you from whom you can buy or. Choose products to sell; Source products; Set up your online store; Check listing and selling costs; Determine payment methods; Manage inventory and shipping. How to Sell Online in 7 Easy Steps · Choose what products to sell · Pick the right domain name · Build your online store · Get payments into your bank account. How to Sell Products Online: 6 Key Steps · Step 1: Find the Right Product to Sell · Step 2: Choose the Right Online Sales Channel · Step 3: Set Up an Online. Opening your own Shop with Spreadshirt add a no-risk, no-fee, no-worries merchandising solution to your business mix. It gives you the ability to style your. Conversion campaigns include goals like add to carts, online sales and offline sales. They're great for brands that don't have a product feed or want more. How to Sell Products Online · 1. Find your products · 2. Identify your niche market · 3. Conduct market research · 4. Create buyer personas · 5. Brand your. Should I Sell Products Online? · Pros · - You'll introduce large audiences to your products. E-commerce sites let you sell products to people worldwide. · - You. To know what popular products to sell online, check Amazon reviews. You will get a first-hand look into what people love or hate about a product. For example. Yes you can sell products without actually having it with you. But you need to have proper link and contact with you from whom you can buy or. Choose products to sell; Source products; Set up your online store; Check listing and selling costs; Determine payment methods; Manage inventory and shipping. How to Sell Online in 7 Easy Steps · Choose what products to sell · Pick the right domain name · Build your online store · Get payments into your bank account. How to Sell Products Online: 6 Key Steps · Step 1: Find the Right Product to Sell · Step 2: Choose the Right Online Sales Channel · Step 3: Set Up an Online.

Begin your merch journey and get ready to make some $$$ · Free set up. Create your online shop and be ready to sell within minutes. · Keep it social. Sell. If you're only selling a handful of items, you can make your sales through eBay and only have to pay % of the sales price back to the platform. However. There are not enough details: For an online eCommerce store, you have to convince and assure shoppers that your product is what they are looking for because. There are three main ways for retailers to sell online without creating their own website. These are through online marketplaces like Amazon and eBay, through. The best way to sell products online without creating a website or doing any additional work is to use an existing online marketplace. Answer: Altru does not have WebForm functionality to sell merchandise items online. If you would like to see this implemented in a future release, we have an. Use special components to highlight new products, top sellers, sale items, or related items to help drive shoppers to the precise inventory you want to move. Best online shop to sell my merchandise? · Your website. It can be as easy as setting up some Paypal buttons. · Facebook/Insta shopping. You. The Best Sites to Sell Online: 10 Marketplaces for Selling Goods or Running a Business. Shopify is an ecommerce platform that's perfect for selling your products online both for beginners as well as experienced entrepreneurs. It allows you to. The most creative way to sell your products is with a Squarespace online store. Allow your customers to browse your merchandise, add items to their cart. The easiest way to sell merch online without inventory is by using an order fulfillment solution like print-on-demand (POD). For example, with Sellfy's POD, you. Choose your products. Identify your target audience. Build your online store. How to find the right product(s) to sell? · Visit services like EcomHunt or FindNiche for inspiration. · Browse shopping platforms, and see if. If you're only selling a handful of items, you can make your sales through eBay and only have to pay % of the sales price back to the platform. However. Selling a product online is easier when you use an e-commerce platform or an online marketplace such as Etsy or Amazon Marketplace, which help small businesses. Sell Merchandise Online And Make Money With Ecwid. Do you sell merchandise online? Create a free Ecwid store and boost your revenue by expanding your reach. apparel from @tanyataylor's. Your shop is a place to sell and share your brand story, where people can browse products and explore collections. example of. There are a lot of platforms where you can sell your products, but the two biggest players are definitely eBay and Amazon. However, there are plenty of viable. It's easy to sell online with lsvtc.ru Partner with the largest multi-channel retailer and put your products in front of millions of Walmart shoppers.

Top Iot Device Manufacturers

Examples of IoT development companies are ELEKS, SoluLab, SumatosSoft, and Innowise. Examples of IoT companies are Apple, Microsoft, IBM, Google, and Oracle. Top 10 Healthcare IoT Companies to Maximize ROI · 1. Toobler · 2. LANARS · 3. Honeywell Life Care Solutions · 4. ScienceSoft · 5. Siemens AG · 6. GE Healthcare · 7. The leading 10 IoT manufacturers include MOKOSmart, Bosch, Cisco, AWS, SAP, Samsara, Sierra Wireless, Telit, Oracle, and Silicon Labs. IT administrators mainly use these solutions, and some companies may even employ an IoT administrator to track the performance, security, and overall state of. IoT Companies to Know · Chamberlain Group · Memfault · Spectrum · AlertMedia · Superpedestrian · Samsara · SimpliSafe · Johnson Controls. iTechArt Group operates from New York, USA. The company specializes in software development and offers valuable IoT solutions for budding startups. The services. Wipro– Internet of Things – Component Developer, Predix IoT, Google IoT are few of the areas that hire IoT professionals at Wipro. L&T–. Top Seattle, WA Internet of Things Companies (54) · Verkada Inc · Arrow Electronics, Inc. · Identity Digital · IonQ · Neposmart · Gemio · Wyze · Sirqul. ARM (Acquired by Softbank) · Atmel (Acquired by Microchip) · Cypress Semiconductor · GainSpan (Acquired by Telit) · Intel · Lantronix · Marvell Technology Group. Examples of IoT development companies are ELEKS, SoluLab, SumatosSoft, and Innowise. Examples of IoT companies are Apple, Microsoft, IBM, Google, and Oracle. Top 10 Healthcare IoT Companies to Maximize ROI · 1. Toobler · 2. LANARS · 3. Honeywell Life Care Solutions · 4. ScienceSoft · 5. Siemens AG · 6. GE Healthcare · 7. The leading 10 IoT manufacturers include MOKOSmart, Bosch, Cisco, AWS, SAP, Samsara, Sierra Wireless, Telit, Oracle, and Silicon Labs. IT administrators mainly use these solutions, and some companies may even employ an IoT administrator to track the performance, security, and overall state of. IoT Companies to Know · Chamberlain Group · Memfault · Spectrum · AlertMedia · Superpedestrian · Samsara · SimpliSafe · Johnson Controls. iTechArt Group operates from New York, USA. The company specializes in software development and offers valuable IoT solutions for budding startups. The services. Wipro– Internet of Things – Component Developer, Predix IoT, Google IoT are few of the areas that hire IoT professionals at Wipro. L&T–. Top Seattle, WA Internet of Things Companies (54) · Verkada Inc · Arrow Electronics, Inc. · Identity Digital · IonQ · Neposmart · Gemio · Wyze · Sirqul. ARM (Acquired by Softbank) · Atmel (Acquired by Microchip) · Cypress Semiconductor · GainSpan (Acquired by Telit) · Intel · Lantronix · Marvell Technology Group.

Top IoT Companies · Connexa · Software Motor Company · TeraCode · Intel · Adlink Technology · Aeris Communications · Armis · Arterra Mobility. Voting statistics · AWS IoT · 7 · Microsoft Azure IoT. 7 · Oracle IoT Cloud Service · 6 · Aeris. 4 · IBM Watson IoT Platform · 4 · Particle. 4 · Huawei Cloud · 4 · Ayla. Automatski Corporation is the topmost underdog in the IoT Industry. It is ranked as one of the top IoT companies in the world. It is an IoT. Altizon Datonis Industrial IoT Platform Great IoT platform which is preferred for analysis and digital manufacturing usage. Can handle rigorous amount of data. Cisco Systems, Inc., lsvtc.ru CO., LTD., lsvtc.ru Table of Contents. What Is IoT? List of 25 IoT Manufacturers; Global. The leading 10 IoT manufacturers include MOKOSmart, Bosch, Cisco, AWS, SAP, Samsara, Sierra Wireless, Telit, Oracle, and Silicon Labs. IoT Companies in USA · Gadgeon Systems Inc · Matellio Inc · Connexa · IoT America · MBicycle · NetObjex Inc. · Syberry · Cyber Infrastructure (p) Ltd. 1. ABB: Smart robotics · 2. Airbus: Factory of the Future · 3. Amazon: Reinventing warehousing · 4. Boeing: Using IoT to drive manufacturing efficiency · 6. Memfault is the first IoT reliability platform that empowers teams to build more robust devices with software at scale. We believe that device reliability. Cisco is also one of the largest cybersecurity companies. The company offers hardware, software, and services aimed at securing networks against threats. Innowise Group has expertise in creating IoT solutions of any complexity. They can help you make the most of your technology investments, whether you need. Pairroxz (5 stars); Riseup Labs (5 stars); Rushkar Technology Private Limited (5 stars); ArcTouch ( stars); Yalantis ( stars). These companies often. List of the USA's Best Internet of Things Companies · SoluLab · Biz4Group LLC · TOPS Infosolutions Pvt. Ltd. · Gadgeon Systems INC · Canyon Development · Octos Global. IBM has been listed in the top for IoT analytics sector. This sector has taken a big step forward on working over increasing in number of. Top IoT Device Manufacturing Companies · Xage · Pragmatic Semiconductor · Cubic Telecom · Finite State · Wirepas · Minut · Infinite Uptime · NquiringMinds. The USA's Internet of Things (IoT) ecosystem is dominated by Verizon, a telecom behemoth. Verizon provides dependable IoT connectivity solutions to businesses. AVSystem Coiote IoT Device Management AVSystem is a vendor of Internet of Things and device management software present on the market since , and. EIO Diagnostics Inc, Plug Power and more Industrial IoT companies in United States from the F6S community. Industrial IoT forms part of the Manufacturing. 4. Intel Corporation: As the brains of connected devices, Intel provides the processing power and connectivity solutions that underpin the IoT. Spurred by the innovative trends revolutionizing the industrial landscape, Manufacturing Technology Insights has compiled a list of 'Top

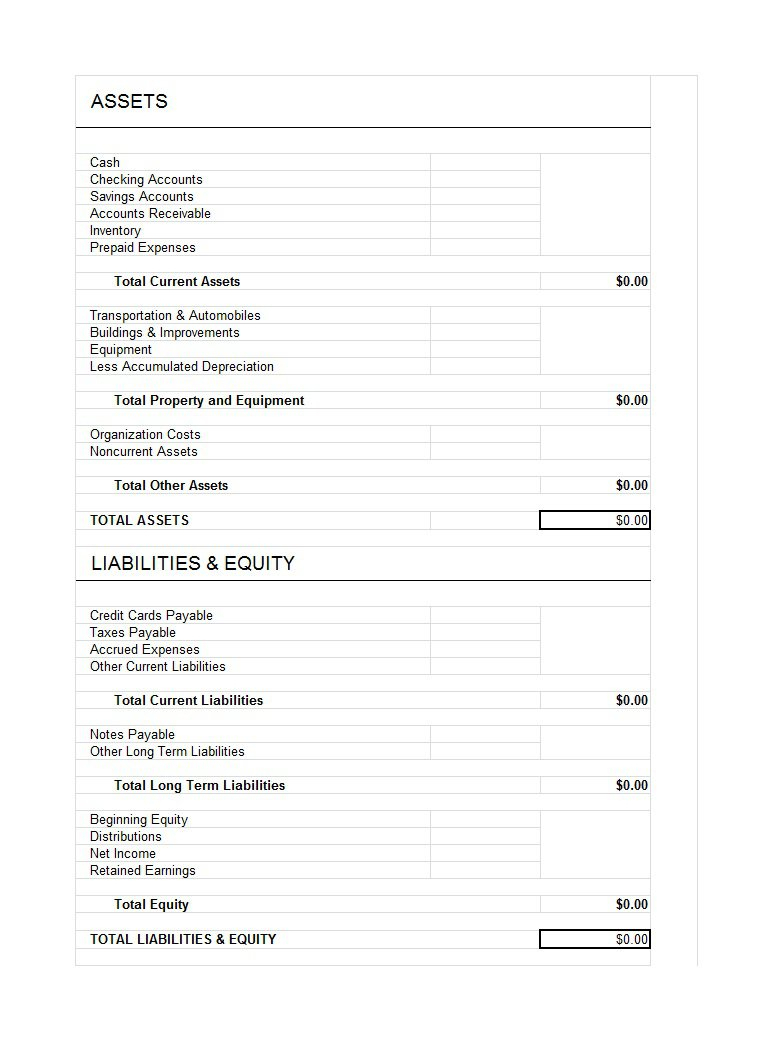

Examples Of Personal Assets And Liabilities

Personal assets are resources that can be used to generate revenue, while personal liabilities are obligations that must be fulfilled. Understanding the. In personal finances, a liability is a debt you owe a lender, such as home mortgages, student loans, car loans and credit card debts. Some forms of liability. Examples of personal assets include: Your home. Other property, such as a rental house or commercial property. Personal assets may include cars and houses, while business assets would include equipment and land. Liabilities are the things that a business or an individual. It provides a full list of their personal assets and liabilities as well as their income and expenses. Examples include: Bank accounts (checking. Asset Examples: Motor vehicles – the current Blue Book value of any cars, motorcycles, boats, RVs, etc. you own. - Real estate –. An asset is anything you own that holds monetary value. That means things like your house, your car, and your checking account funds are considered assets. Liabilities are amounts you owe to someone else, either immediately or over a long period. One way to obtain an expensive asset is by taking out a loan (e.g., a. An asset is something that puts money in your pocket whereas a liability moves money out of your pocket. Understanding the difference between the two and. Personal assets are resources that can be used to generate revenue, while personal liabilities are obligations that must be fulfilled. Understanding the. In personal finances, a liability is a debt you owe a lender, such as home mortgages, student loans, car loans and credit card debts. Some forms of liability. Examples of personal assets include: Your home. Other property, such as a rental house or commercial property. Personal assets may include cars and houses, while business assets would include equipment and land. Liabilities are the things that a business or an individual. It provides a full list of their personal assets and liabilities as well as their income and expenses. Examples include: Bank accounts (checking. Asset Examples: Motor vehicles – the current Blue Book value of any cars, motorcycles, boats, RVs, etc. you own. - Real estate –. An asset is anything you own that holds monetary value. That means things like your house, your car, and your checking account funds are considered assets. Liabilities are amounts you owe to someone else, either immediately or over a long period. One way to obtain an expensive asset is by taking out a loan (e.g., a. An asset is something that puts money in your pocket whereas a liability moves money out of your pocket. Understanding the difference between the two and.

Writing Your List · Financial assets also include home, car, and personal loans, retirement and investment accounts, and credit cards. · Don't worry about making. Assets vs. Liabilities · Bank debt · Mortgage debt · Money owed to suppliers (accounts payable) · Wages owed · Taxes owed. This Assets, Liabilities and Net Worth worksheet is what you use to calculate the difference Personal Use Assets. ▫ Residence. $ ______. Mortgage. $ ______. Calculate your net worth using a list of what you own (assets) and what you owe (liabilities) at a given point in time. Your balance sheet is a useful tool. Personal assets are those that belong to individuals. These are more traditional assets, such as stocks, bonds, and real estate. Personal liabilities can be shown at the bottom of the liabilities column. These include consumer debts, credit card balances, home mortgages, and medical bills. An asset is a thing the business owns · Liquid assets: Cash and cash equivalents (liquid investments like stocks and bonds). · Illiquid assets: Things that might. If you reside in a community property state, all assets and liabilities, except the ownership interest in the firm, should be halved accordingly on the form. TOTAL LIABILITIES= SURPLUS ASSETS OVER LIABILITIES = R I/we hereby certify that the above is a full and true statement of my/our personal assets. What are assets and liabilities? · Credit cards · Student loans · Unpaid medical bills or unpaid taxes · Mortgages or vehicle loans · Loans that you have co-signed. Examples include credit card balances, personal or auto loans liabilities, subtract the total amount of liabilities from the total amount of assets. See the following page for a sample format. Important: Please do not submit a Statement of Personal Net Worth via email. Your ODC contact can advise you on a. Assets vs. Liabilities · Bank debt · Mortgage debt · Money owed to suppliers (accounts payable) · Wages owed · Taxes owed. The balance sheet part of the personal financial statement lists the individual's assets and liabilities, just as the balance sheet for a business lists all the. Liabilities are amounts you owe to someone else, either immediately or over a long period. One way to obtain an expensive asset is by taking out a loan (e.g., a. Examples of Assets vs Liabilities · Example 1: Freelance Copywriting Business · Example 2: Hot Sauce Manufacturing Business · Example 3: House Painting Business. Examples include: Home loan/mortgage; Maximum limit on a credit card (lenders Maximum limit for a personal loan or overdraft; Any study/student loans. Personal Assets and Liabilities (to be completed for each individual or jointly). Individual 1. Individual 2. Name. Real-estate Assets. Property Address. Owners. PERSONAL STATEMENT OF ASSETS AND LIABILITIES. CLIENT, SPOUSE. Name: Asset Contingent Liabilities (for example suretyships). 1. 2. TOTALS. NET ASSETS. For example, cash equivalents, stock, marketable securities and short-term deposits are some of the most common current assets. Fixed Assets or Long-term Assets.

Real Estate Investor Financing Options

1. Conventional Mortgage Loans. Conventional mortgage loans are a popular choice for financing investment properties. · 2. FHA Loans · 3. VA Loans · 4. Portfolio. Investment Property Financing Investing in real estate can provide both immediate and long-term financial rewards. Whether you're considering a single-family. I would suggest new real investor financing through hard money loans, hybrid loans, asset-based mortgages, and an FHA loan”. For investors wondering how to. Best for more experienced investors and/or investors with insufficient W2 Income. Learn more →. Hard money loans. Quick financing. The basic loan for an investment property is a residential loan, like the one homeowners have on their residence, most of which have a year term. Residential. Real estate investing can create a steady stream of cash flow, bringing in more reliable monthly income than other investments. It also comes with tax. You will need both equity investments from outside investors and debt financing. There are a few options for both of these choices. Real estate investing can create a steady stream of cash flow, bringing in more reliable monthly income than other investments. It also comes with tax. Financing Your Real Estate Investment · 1. Traditional Mortgages · 2. Hard Money Loans · 3. Private Money Lenders · 4. Real Estate Crowdfunding · 5. Seller Financing. 1. Conventional Mortgage Loans. Conventional mortgage loans are a popular choice for financing investment properties. · 2. FHA Loans · 3. VA Loans · 4. Portfolio. Investment Property Financing Investing in real estate can provide both immediate and long-term financial rewards. Whether you're considering a single-family. I would suggest new real investor financing through hard money loans, hybrid loans, asset-based mortgages, and an FHA loan”. For investors wondering how to. Best for more experienced investors and/or investors with insufficient W2 Income. Learn more →. Hard money loans. Quick financing. The basic loan for an investment property is a residential loan, like the one homeowners have on their residence, most of which have a year term. Residential. Real estate investing can create a steady stream of cash flow, bringing in more reliable monthly income than other investments. It also comes with tax. You will need both equity investments from outside investors and debt financing. There are a few options for both of these choices. Real estate investing can create a steady stream of cash flow, bringing in more reliable monthly income than other investments. It also comes with tax. Financing Your Real Estate Investment · 1. Traditional Mortgages · 2. Hard Money Loans · 3. Private Money Lenders · 4. Real Estate Crowdfunding · 5. Seller Financing.

You have options—Consider a bank like New American Funding to get financing for your investment property loan rather than a big bank if you don't have as big of. 85% Example: A year, fixed-rate loan of $1,, with an interest rate of % / % APR will have monthly principal and interest payments of. If you're building a portfolio of investment properties, you will need the right kind of financing. Our rental loans offer the maximum flexibility of 5-year to. Investment property loans vs. conventional loans ; Loan amount, $,, $, ; Interest rate, 7%, % ; Monthly payment (Principal and interest), $2, At Freedom Capital, our experts are available round-the-clock to help you with your unique investment property mortgage financing needs. So, your mortgage. 1. Know your options. The real estate market has a variety of financing options available for investors. · 2. Work with a Private Lender or Mortgage Broker · 3. Interest rates for investment property mortgages tend to be % to % higher than those of primary residence mortgages. Why? Because when push comes to. Interest rates for investment property mortgages tend to be % to % higher than those of primary residence mortgages. Why? Because when push comes to. Option 1. Cash-Out Refinance. One of the quickest creative financing options you have available, if you own the home you live in, is to tap into your existing. Investment real estate financing allows you to use equity in commercial real estate you own to quickly access cash that can be used for business or portfolio. There are many loan options available for commercial real estate investment properties. But first, make sure you are building and maintaining a strong business. Home loans are the most common and popular financing option for purchasing residential properties. Banks and non-banking financial companies . Compare the Best Investment Property Loans ; Rate Best Overall, Best for New Construction, Best for Fast Closing, 15% ; Rocket Mortgage Best for Customer. Most lenders require 20% or even 25% down (to get the lowest rate investor loan). The founders of Hurst Lending are real estate investors. Investing in real estate to diversify your wealth portfolio · Diversification · Cash flow · Favorable tax treatment · Customized financing options and risk. Rather than coming from a bank, the funds for these investments come from a private individual or group. Because these loans do not need to go through any. Navy Federal offers a year conventional fixed rate 2 designed to maximize your return on investment. But a traditional mortgage can also be used to finance investment properties. The same qualifications apply as if you were purchasing a residential property: a. Unlike traditional loans, seller financing works like this: the investor purchases the property from the homeowner/seller, rather than a bank, and the two sides. Non-Owner-Occupied Investment Property · Mortgage Loans with downpayment options as low as 25% of the loan amount are available for unit properties.

Boiler Water Pump Replacement Cost

A circulating pump (also called a circulator pump) can be an expensive repair, from around $ to $1,, including labor. Brand, size, and speed all affect. The average cost to replace a boiler is about $8,—and the costs get even higher if you have to replace radiators in your home as well (3, 4). This is. Looks like a Taco ($), PRV is about ($), mixing valve ($). Labor and trip charge adds on to that. In general, water heaters can be replaced for around $$ to $2, per heater. Tankless water heaters will cost more, usually in a fairly wide range. Water Source Heat Pump Repair. Water source heat pump repair costs from $ to $1, This type of system uses pipes that are located at the bottom of a lake. Plumbers replaced central heating pump (Grundfos). They bled all radiators and checked central heating boiler and unvented lsvtc.ru taken just over 2 hours. The most expensive was a $ replacement. That was a total rip off as the pump costs $90 on lsvtc.ru In addition, many electric utilities and municipalities offer incentives for purchasing a heat pump water heater, typically ranging from $ - $1, Finally. Circulation Replacement Pumps for Solar Water Heater Boiler Circulating Cast Iron Flange Price & Deals. Price. $18 – $2,+. Deals & Discounts. All. A circulating pump (also called a circulator pump) can be an expensive repair, from around $ to $1,, including labor. Brand, size, and speed all affect. The average cost to replace a boiler is about $8,—and the costs get even higher if you have to replace radiators in your home as well (3, 4). This is. Looks like a Taco ($), PRV is about ($), mixing valve ($). Labor and trip charge adds on to that. In general, water heaters can be replaced for around $$ to $2, per heater. Tankless water heaters will cost more, usually in a fairly wide range. Water Source Heat Pump Repair. Water source heat pump repair costs from $ to $1, This type of system uses pipes that are located at the bottom of a lake. Plumbers replaced central heating pump (Grundfos). They bled all radiators and checked central heating boiler and unvented lsvtc.ru taken just over 2 hours. The most expensive was a $ replacement. That was a total rip off as the pump costs $90 on lsvtc.ru In addition, many electric utilities and municipalities offer incentives for purchasing a heat pump water heater, typically ranging from $ - $1, Finally. Circulation Replacement Pumps for Solar Water Heater Boiler Circulating Cast Iron Flange Price & Deals. Price. $18 – $2,+. Deals & Discounts. All.

For one-for-one water heater replacement, allow around $ to $ for installation costs. This figure assumes easy access and minimal new installation work. Central Heating Pump Replacement Cost & Guide · Which are the best central heating pumps? · Make sure you disconnect electrical wires · Turn off Outlet and Inlet. In general, small repairs such as replacing components or cleaning out blocked pipes can range from $$ while larger repairs cost upwards of $1, Fortunately Luis at Elmont helped me and suggested I try the Taco pump, citing its low cost and ease of replacement (once you put in the pump, you can replace. Replacing a boiler system will cost on average about $7,, although this can vary depending on the size of your home and the type of boiler you choose, among. FAQ: Boiler Repair Services · What is the average boiler repair cost? The average boiler repair cost is about $ to $ depending on the repair issue and the. Boiler Install For As Low As $/Mo*. $/mo. *Subject to credit approval. Ask for details. Request. The cost tends to range from $ to $ (for equipment only). Installing a Combi Condensing Boiler will cost around $5, – $8, in a lsvtc.ru home. components to feed water to a boiler. Challenges. The facility's engineers Replacing Wear Parts for Boiler Feed Pump Helps Reduce Operating Costs. The system doesn't need a cylinder to store the water because the combination boiler heats the water directly from the mainline. Cost estimates for combination. How much does it cost to replace a boiler pump? Boilers are essential equipment in every home. They provide hot water and heating during the cold season. Below are some signs, which mean that there is some problem with the pump. The pump is running, however, water on the flow pipe is not hot; The pump is dripping. A boiler pump or central heating pump works by circulating water from the boiler through the pipes to the radiators and back again. They are typically located. This circulator has the same specifications as the rugged Grundfos 1/6 hp pump that we have used in outdoor boiler hydronic applications for 30 years. That. The average cost of a new heat pump installation is $5, Most homeowners spend in the range of $4,$7, The original cost will depend on a number of. While the average boiler replacement cost is between $5, and $8,, the boiler price ranges dramatically depending on things like the type of boiler. That. In general, small repairs such as replacing components or cleaning out blocked pipes can range from $$ while larger repairs cost upwards of $1, The initial cost to install the water piping for a radiant heating system Besides the gas consumption of the boiler, water pumps use electricity to pump the. Water heater replacement costs range from $ to $1,, with the average cost being $1, Your total price depends on whether you're doing a simple one-. Placed in a boiler room with a boiler circulating pump, a boiler installation has the following components: burner, nozzles, boiler casing, hot-water tank .

Ally Bank Savings Account Interest Rate

With a rate this good, why stash your cash anywhere else? Ally Bank Savings Account SPEND How an interest checking account works. 3 min read. DEBT Should. $15, or more = % Annual Percentage Yield (APY). Bank better. Best for: Saving at a competitive rate. Access your money at any time, including by debit card and checks. Annual Percentage Yield % on all balance tiers. Very high annual percentage yield (APY). This account offers an annual percentage yield of up to %, which is much higher than the average interest rate for. Best for: Saving at a competitive rate. Access your money at any time, including by debit card and checks. Annual Percentage Yield % on all balance tiers. Additional Info. Annual Percentage Yield % on all balance tiers! Deposit checks remotely with Ally eCheck Deposit. Make unlimited ATM withdrawals at one of. Grow your money with an Online Savings Account. Ally Bank's high interest account features a competitive rate and savings tools. Ally Bank, Member FDIC. Ally Bank Savings Account · Its savings account earns an APY of % APY on all balances which beats the national average for savings accounts (% APY as of. I checked on my Ally accounts today and noticed on the website that the HYSA and money market savings account interest has dropped to %. So. With a rate this good, why stash your cash anywhere else? Ally Bank Savings Account SPEND How an interest checking account works. 3 min read. DEBT Should. $15, or more = % Annual Percentage Yield (APY). Bank better. Best for: Saving at a competitive rate. Access your money at any time, including by debit card and checks. Annual Percentage Yield % on all balance tiers. Very high annual percentage yield (APY). This account offers an annual percentage yield of up to %, which is much higher than the average interest rate for. Best for: Saving at a competitive rate. Access your money at any time, including by debit card and checks. Annual Percentage Yield % on all balance tiers. Additional Info. Annual Percentage Yield % on all balance tiers! Deposit checks remotely with Ally eCheck Deposit. Make unlimited ATM withdrawals at one of. Grow your money with an Online Savings Account. Ally Bank's high interest account features a competitive rate and savings tools. Ally Bank, Member FDIC. Ally Bank Savings Account · Its savings account earns an APY of % APY on all balances which beats the national average for savings accounts (% APY as of. I checked on my Ally accounts today and noticed on the website that the HYSA and money market savings account interest has dropped to %. So.

What are buckets? · Am I earning interest on money in my buckets? · Can I set up recurring transfers to go into my buckets? · Can you create multiple buckets in. Ally's Online Savings Account also features a solid % APY, as well as decent rates for the bank's Interest Checking and Money Market accounts. Ally does. The APY of our Savings Account is more than 5x the national average of % APY, based on the national average of savings accounts rates published in the FDIC. Compare our savings, CD, money market, checking and IRA rates and features all in one place. Straightforward with no hidden fees. Ally Bank Member FDIC. With a high-yield savings account like the Ally Bank Savings Account, which offers % APY, you'll be able to earn interest on your savings while knowing your. With a high-yield savings account like the Ally Bank Savings Account, which offers % APY, you'll be able to earn interest on your savings while knowing your. Ally bank determine the interest paid to a savings account? I'm rate to the principal and interest that has accrued to the account each day. Ally Bank Savings Account · No minimum balance. · No maintenance fees. · Competitive interest rate. · Interest compounded daily. · No overdraft fees. · Direct deposit. Other banks we considered: This high-yield savings account has an interest rate of %, but its Marcus Invest tool is geared toward people looking for a robo. UFB Direct: % APY. UFB Direct is an online bank and a division of the more widely known Axos Bank. Its branchless, online-only model allows it to keep. Rates for Ally's High Yield CDs range from % to %. Meanwhile, the savings account rate for all balance tiers at Ally is % APY on all balances APY. The Ally Bank Savings Account offers an annual percentage yield (APY) of %, with no monthly maintenance fees or minimum balance requirements. Ally Bank CD Rates. Ally Bank Savings rates. Rate History for Ally Bank. Best CD Rates and Savings Rates. Will earn variable interest rate of % APY. Page 4. Connecticut Community Bank –. Statement Savings Account. Minimum to open account is $ Ally Bank should rank highly on your list of options to consider. Because it is an online bank, it can offer better rates, as it does not have to worry about. Ally Bank Savings Rate August - Earn % APY · Ally Bank provides a high-yield savings account option with an APY of %. · There are no minimum deposit. Open in the name of a trust. · No monthly maintenance fees or minimum balance requirements. · 24/7 support. · Direct deposit is a breeze. The Ally money market account shares many features with the savings account. The rate is relatively high (currently % APY) and has a limit of Ally Bank CDs: Key Features ; %%1 · None · 3 months–5 years · 60 days of interest for 24 months or less; 90 days of interest for 25 to 36 months; days. High-Interest Savings Accounts from Discover Bank, Member FDIC offer high yield interest rates with no monthly balance requirements or monthly fees.